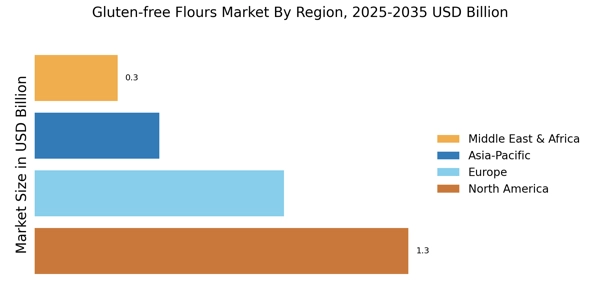

The study provides market insights for the region classified into Europe, North America, Asia-Pacific and the Rest of the World. The North American Gluten-free flour market will dominate due to increasing knowledge of the importance of limiting gluten intake in daily diets, increased bread and cereal consumption, widespread availability of gluten-free items, and rising obesity rates in these countries.

Furthermore, the major countries studied in the market report are India, Australia, German, France, the UK, Italy, Spain, China, Japan, The US, Canada, South Korea, and Brazil.

Figure 2: GLUTEN-FREE FLOURS MARKET SHARE BY REGION 2022 (USD Billion)

Europe's Gluten-free flour market accounts for the second-largest market share because of its high employment of no-gluten flour. In European cuisines, gluten-free flour is used in pasta, snacks, noodles, and bread. Furthermore, the German Gluten-free flour market had the biggest market share, while the UK Gluten-free flour market was the fastest expanding market in the European region.

The Asia-Pacific Gluten-free flour Market is expected to grow at the fastest CAGR from 2023 to 2032. Because of variables such as rising internet penetration, a thriving e-commerce business, and favorable demographics, regional market conditions are quite promising. Consumers in the country include those with celiac disease or gluten intolerance/sensitivity and others who are health-conscious and require these goods for weight loss. Furthermore, China's Gluten-free flours Market had the highest market share, while India's Gluten-free flours Market was the fastest expanding in the Asia-Pacific region.

Recent News

In January 1, 2023: The Full of Beans Gluten Free Brand will be acquired by Arva Flour Mills, the oldest continuously running commercial flour mill in North America

In June, "The Mill" intends to open their retail location and their website, www.arvaflourmill.com, for the debut of their Gluten Free line under the Arva Flour Mills brand. This summer, more distribution plans to open up additional retail outlets for the Arva Flour Mills Gluten Free brand are anticipated.

Natural Products Expo West 2024 will see the debut of a new line of premium organic flours from Nature's Path. According to the firm, the flours are created using a wide range of grains that are ground at a low temperature and combined slowly for optimal effects. Numerous health benefits of whole grains, such as high fiber content, are also included in the blends.

In 2021: Ulrick & Short introduced a new functional rice flour claiming it enhances viscosity, texture, and structure in baked goods without gluten. Ulrick & Short introduced their functional flour line last year and has since added Fazenda Nutrigel in response to the growing gluten-free trend in the bakery industry. The novel component has been developed to enhance the moisture, softness, and structure of both sweet and savory bakery applications, including breads, cakes, muffins, batters, and coatings. It is said to function as a viscosity regulator in bakery applications.