Culinary Versatility of Amaranth

The culinary versatility of amaranth is a significant driver for the Amaranth Market. This grain can be utilized in various forms, including flour, seeds, and flakes, making it suitable for a wide range of recipes, from baked goods to breakfast cereals. Its unique texture and nutty flavor enhance the appeal of numerous dishes, attracting both home cooks and professional chefs. As the food industry continues to innovate, amaranth is likely to be featured in new product lines, including snacks and ready-to-eat meals. This versatility not only broadens its market reach but also encourages experimentation among consumers, thereby fostering growth within the Amaranth Market.

Nutritional Benefits of Amaranth

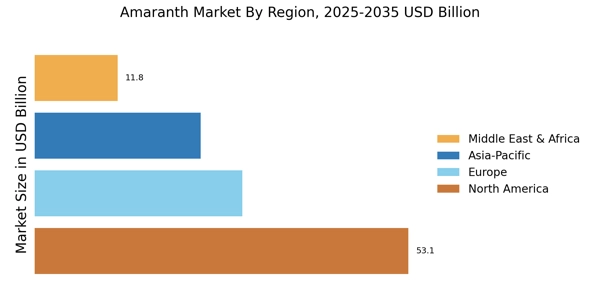

The Amaranth Market is experiencing a surge in demand due to the increasing awareness of the nutritional benefits associated with amaranth consumption. This ancient grain is rich in protein, fiber, and essential amino acids, making it a preferred choice among health-conscious consumers. Studies indicate that amaranth contains higher levels of lysine compared to other grains, which is crucial for muscle repair and growth. Furthermore, its gluten-free nature appeals to individuals with gluten sensitivities, thereby expanding its consumer base. As more people seek nutritious alternatives to traditional grains, the Amaranth Market is likely to witness sustained growth, with projections suggesting a compound annual growth rate of over 5% in the coming years.

Growing Interest in Ancient Grains

The Amaranth Market is benefiting from a broader trend towards ancient grains, which are perceived as healthier and more sustainable options compared to conventional grains. This interest is fueled by consumers' desire for diverse diets that include nutrient-dense foods. Amaranth, along with quinoa and millet, is gaining traction as a staple in health food stores and specialty markets. The market for ancient grains is projected to reach substantial figures, with amaranth expected to capture a significant share due to its unique flavor and versatility in various culinary applications. This trend indicates a shift in consumer preferences, which could further bolster the Amaranth Market in the near future.

Increased Availability in Retail Channels

The Amaranth Market is witnessing increased availability through various retail channels, which is enhancing consumer access to this nutritious grain. Supermarkets, health food stores, and online platforms are expanding their offerings of amaranth products, catering to the rising demand. This accessibility is crucial for educating consumers about the benefits of amaranth and encouraging trial purchases. Additionally, partnerships between producers and retailers are likely to facilitate better distribution and marketing strategies, further promoting amaranth as a staple food. As more consumers become aware of amaranth's health benefits and culinary uses, the Amaranth Market is expected to grow, supported by improved retail presence.

Sustainability and Environmental Concerns

The Amaranth Market is increasingly influenced by sustainability and environmental concerns. Amaranth Market is known for its resilience and ability to thrive in diverse climatic conditions, requiring less water and fewer pesticides compared to traditional crops. This characteristic aligns with the growing consumer demand for sustainable food sources. As agricultural practices shift towards more eco-friendly methods, amaranth is positioned as a viable option for farmers looking to reduce their environmental footprint. The market for sustainable products is expanding, and the Amaranth Market stands to benefit from this trend, as consumers are more inclined to support products that contribute to environmental conservation.