Research Methodology on Nutricosmetics Market

The research methodology used in this study is based on an extensive analysis of the industry, market and competitive landscape of the nutricosmetics market, which includes both primary and secondary sources of information. Primary research involves interviews and surveys with key industry and market participants. Secondary data includes internal and external sources such as published and unpublished reports, regional and global periodicals, industry and market reports, press releases, and other sources.

Primary research: Primary research requires the analysis of relevant industry stakeholders such as costs, consumers, market size, distribution channels, and competition. Primary research generally includes personal interviews with industry executives, market participants, and other experts. The identified industry participants and experts are contacted by phone and/or through the distribution of questionnaires. The aim is to gain a comprehensive understanding of the market size, industry structure, and competitive landscape.

Secondary research: Secondary research provides data for the market size and structure. Sources such as published journals, key players’ websites, and press releases from organizations active in the market will be used to obtain this data. This data is then verified by conducting structured interviews with key experts in the industry.

Data Triangulation: The data collected through primary and secondary sources is triangulated and compared to provide a comprehensive view of the market. The data is further validated to ensure accuracy.

Global Market Size Estimate: The global market size of nutricosmetics has been estimated based on the total available revenues of nutricosmetics companies, market survey results, market research reports, and interviews with industry experts. The global market size is estimated based on historical data, recent trends, and current market dynamics.

Definitional Clarity: The market size of nutricosmetics is defined according to the definition provided by the relevant industry organizations. It includes the revenues generated by the sales of the product, its static and dynamic components, and its future prospects.

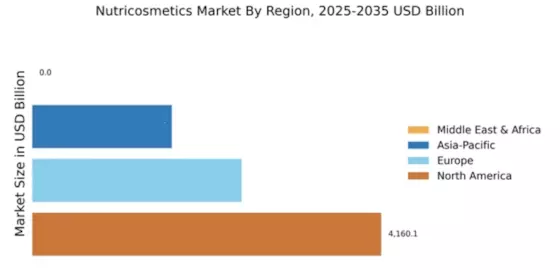

Geographical Coverage: The global market size for nutricosmetics covers the Americas, Europe, Asia-Pacific, and the Rest of the World. Specific geographical sub-regions or countries will also be included in the coverage.

Competitive Landscape: A detailed analysis of the competitive landscape of nutricosmetics is done to provide a clear view of market share, segmentation, and product differentiation. This analysis also covers important developments and strategies adopted by participants in the competitive landscape.

Market Drivers and Restraints: Market drivers such as an increased focus on health and wellness, and the growing demand for other beauty supplements, will be discussed. In addition, market restraints such as regulatory constraints and the lack of standardization will also be discussed in the study.

Data Analysis & Forecasting: In this study, historic and current data is analyzed and forecasted to provide an accurate assessment of the global market size and growth of nutricosmetics.

Report Summary: This report provides a comprehensive market analysis and outlook of the nutricosmetics market. It also covers the industry and competitive landscape, along with detailed information about the market size and growth, key players and their strategies, regulatory environment, industry dynamics, and key opportunities and threats.