Research Methodology on Plant-Based Food Market

Market Research Future (MRFR) has developed a global plant-based food market research report with the help of a comprehensive methodology. This research study mainly focuses on the historical and forecast global plant-based food market outlook, with secondary data sources such as industry interviews, PubMed, journals, magazines, and interviews.

Primary Research

The primary research component of the report is based on data collected through interviews. MRFR conducted both in-depth interviews and one-on-one interviews with executives and stakeholders and customers of the plant-based food market. The interviews are conducted within the Asia-Pacific, North America, Europe, and Latin America regions, to understand their perspective on the global plant-based food market. Further, primary research is also conducted to identify product pricing and industry trends in different forms, such as retail prices, wholesale prices, and regional prices.

Secondary Research

The secondary research component of this report comprises various sources, such as trade journals, paid databases, company websites and presentations, industry associations, and company press releases. The report is developed based on secondary research and primary data collection methodology.

Market Sizing

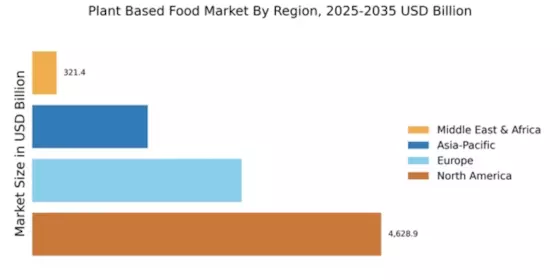

The Market Sizing metric of the Report is based on the evaluation and comparison of the region-wise market share and expenditure for the different product types. For instance, the market share of Plant Based Food in North America is gauged by taking into consideration the current expenditure and market size in the US and Canada. Moreover, MRFR collected historical market data and analyzed the global plant-based food market trends to identify and estimate the size of different market segments.

Data Triangulation

The Data Triangulation method is used to validate the Market Sizing, with the help of secondary data sources and primary activities. The consumption values and pricing trends for the different types of plant-based food are triangulated based on the consumption trends, processing chain, value chain, and supply chain, in the respective market segments. This methodology is used to create comprehensive insights into this market, in terms of price and usage, globally. Furthermore, the data triangulation method is used to validate the estimates and figures mentioned in the report.

Market breakdown and data triangulation

The Market Breakdown and Data Triangulation process are used to analyze the market size of the global plant-based food market. The market size is broken down based on product type, end-use, distribution channel, and region. Further, the secondary and primary sources of data are triangulated to gain a holistic view of the market.

Model Evaluation

The Market Model Evaluation process is used to evaluate the data collected from diverse sources and secondary sources. Data is evaluated from five viewpoints and the relative weightage of the impact that each of these views had on the market is extrapolated. Furthermore, the quantitative model assessment is used to validate the data and the results that are generated from the different sources.

Vendor Analysis

The vendor analysis process is used to evaluate the different products and services offered by the prominent players in the global plant-based food market. The financial and business performance of the major manufacturers and their strategies for growth and production capabilities are studied in detail. Further, the vendor landscape of this market is profiled with the help of Porter’s Five Forces Model.

End-user Analysis

The end-user analysis process is used to analyze the different types of end-users and their usage patterns of plant-based food. This analysis provides valuable insights into user demand and preferences which will help the market players to plan their product strategies accordingly.

Primary sources

- Industry experts

- Executives

- Stakeholders

Secondary sources

- White papers

- Company press releases

- Trade magazines

- Government websites

- Industry reports

- Investment reports

- Conference proceedings