Aging Population

The demographic shift towards an aging population in the US is significantly influencing the nutricosmetics Market. As the population ages, there is an increasing focus on maintaining youthful skin and overall health. This trend is particularly pronounced among individuals aged 50 and above, who are more likely to invest in products that promise anti-aging benefits. The nutricosmetics Market is expected to benefit from this demographic change, with a notable increase in product offerings targeting this age group. It is estimated that by 2030, nearly 20% of the US population will be over 65, further driving the demand for nutricosmetics that cater to their specific needs.

Focus on Holistic Health

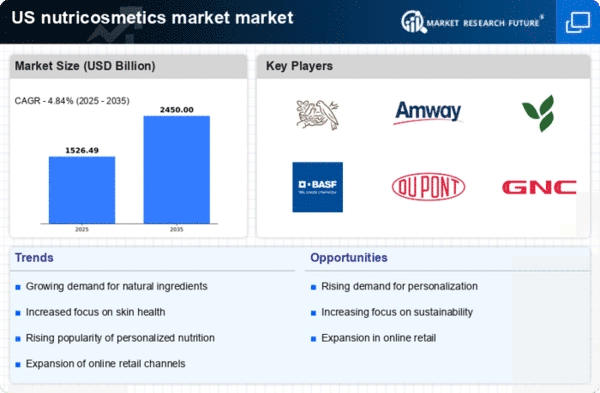

The growing trend towards holistic health and wellness is a crucial driver for the nutricosmetics Market. Consumers are increasingly seeking products that not only enhance beauty but also promote overall well-being. This shift is reflected in the rising demand for nutricosmetics that incorporate vitamins, minerals, and other beneficial ingredients aimed at improving skin, hair, and nail health from within. The nutricosmetics Market is expected to see a rise in formulations that emphasize this holistic approach, appealing to health-conscious consumers. As of 2025, the market is projected to grow by approximately 10% annually, driven by this increasing focus on comprehensive health solutions.

Rise of E-commerce Platforms

The expansion of e-commerce platforms is transforming the way consumers access nutricosmetics, thereby acting as a significant driver for the nutricosmetics Market. Online shopping provides convenience and a wider selection of products, allowing consumers to explore various brands and formulations without geographical limitations. In 2025, e-commerce sales in the beauty and personal care sector are projected to account for over 30% of total sales, indicating a shift in purchasing behavior. This trend is likely to enhance the visibility of nutricosmetics, making it easier for consumers to discover and purchase these products, thus contributing to market growth.

Increasing Consumer Awareness

The growing awareness among consumers regarding the benefits of nutricosmetics is a pivotal driver for the nutricosmetics Market. As individuals become more informed about the impact of nutrition on skin health, hair vitality, and overall appearance, the demand for these products is likely to surge. Reports indicate that the nutricosmetics Market is projected to reach approximately $7 billion by 2027, reflecting a compound annual growth rate (CAGR) of around 8%. This heightened awareness is not only fostering interest in nutricosmetics but also encouraging consumers to seek products that align with their health and beauty goals, thereby propelling the market forward.

Influence of Social Media and Influencers

The role of social media and influencers in shaping consumer preferences is increasingly evident in the nutricosmetics Market. Platforms such as Instagram and TikTok have become vital channels for marketing beauty and wellness products, with influencers often endorsing nutricosmetics to their followers. This trend appears to create a sense of trust and authenticity, encouraging consumers to try new products. As of 2025, it is estimated that over 70% of consumers are influenced by social media when making beauty-related purchases. This dynamic is likely to continue driving the growth of the nutricosmetics Market as brands leverage influencer partnerships to reach wider audiences.