Rise of E-commerce Platforms

The proliferation of e-commerce platforms is transforming the way consumers access nutricosmetics, significantly impacting the nutricosmetics market. With the convenience of online shopping, consumers can easily explore a wide range of products, read reviews, and compare prices. This shift is particularly evident in North America, where online sales of beauty and wellness products have seen a remarkable increase, accounting for nearly 30% of total sales in the sector. The accessibility provided by e-commerce is likely to drive sales further, as consumers increasingly prefer the convenience of purchasing nutricosmetics from the comfort of their homes.

Focus on Clean Label Products

The increasing demand for clean label products is reshaping the nutricosmetics market. Consumers are becoming more discerning about the ingredients in their products, seeking transparency and natural formulations. This trend is particularly pronounced in North America, where a significant portion of the population is inclined to choose products that are free from artificial additives and preservatives. As a result, brands are reformulating their offerings to align with these preferences, which could potentially lead to a market expansion. The clean label movement is expected to contribute to a projected growth rate of 7% in the nutricosmetics market over the next few years.

Influence of Social Media and Influencers

The role of social media and influencers in shaping consumer preferences is a notable driver in the nutricosmetics market. Platforms such as Instagram and TikTok have become vital channels for brands to engage with potential customers, showcasing the benefits of nutricosmetics through visually appealing content. Influencers often share personal testimonials and experiences, which can significantly sway consumer purchasing decisions. In North America, it is estimated that over 70% of consumers are influenced by social media when making beauty-related purchases, indicating a strong correlation between online presence and market growth for nutricosmetics.

Increasing Consumer Awareness of Health Benefits

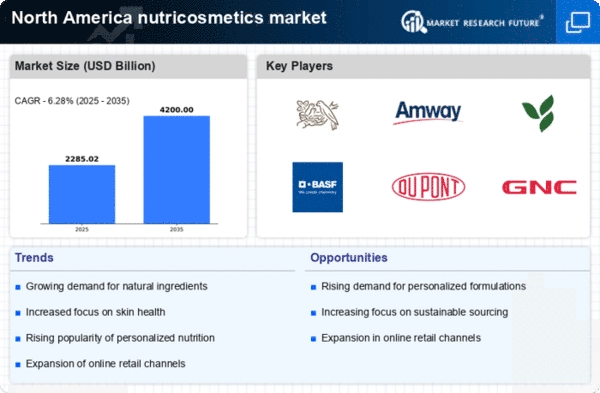

The growing awareness among consumers regarding the health benefits of nutricosmetics is a pivotal driver in the nutricosmetics market. As individuals become more informed about the impact of nutrition on skin health, hair vitality, and overall well-being, the demand for these products is likely to surge. Reports indicate that the nutricosmetics market in North America is projected to reach approximately $3 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. This heightened awareness is not only fostering interest in nutricosmetics but also encouraging manufacturers to innovate and expand their product lines, thereby enhancing market growth.

Aging Population and Demand for Anti-Aging Solutions

The aging population in North America is driving the demand for anti-aging solutions, which is a crucial factor in the nutricosmetics market. As the demographic landscape shifts, more individuals are seeking products that promote youthful skin and overall vitality. This trend is underscored by the fact that nearly 40% of consumers aged 50 and above are actively purchasing nutricosmetics to address aging concerns. The nutricosmetics market is likely to benefit from this demographic shift, with projections indicating a potential increase in market value to $4 billion by 2027, as brands cater to the specific needs of this growing consumer segment.