Germany : Strong Demand and Innovation Drive Growth

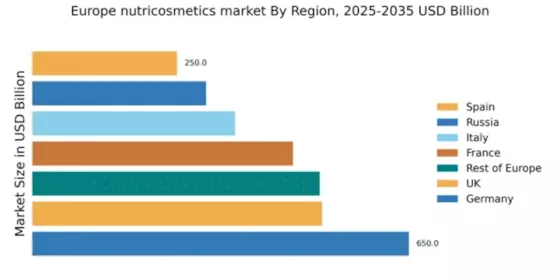

Germany holds a dominant position in the European nutricosmetics market, valued at $650.0 million, accounting for approximately 30% of the total market share. Key growth drivers include a rising awareness of health and beauty, coupled with an increasing demand for natural ingredients. Regulatory policies favoring clean labeling and transparency further enhance consumer trust. The robust infrastructure and advanced industrial capabilities support the rapid development of innovative products in this sector.

UK : Consumer Trends Favoring Health and Beauty

The UK nutricosmetics market is valued at $500.0 million, representing about 23% of the European market. Growth is fueled by a shift towards holistic health and beauty solutions, with consumers increasingly seeking products that combine skincare and nutrition. Government initiatives promoting health awareness and sustainable practices are also pivotal. The market benefits from a well-established retail infrastructure, including e-commerce platforms that cater to diverse consumer preferences.

France : Strong Market with Premium Products

France's nutricosmetics market is valued at $450.0 million, capturing around 20% of the European market share. The growth is driven by a cultural emphasis on beauty and wellness, with consumers willing to invest in premium products. Regulatory frameworks support innovation while ensuring product safety. The market is characterized by a strong presence of luxury brands and a growing trend towards organic and natural formulations, reflecting consumer preferences for quality and efficacy.

Russia : Growing Interest in Health Solutions

Russia's nutricosmetics market is valued at $300.0 million, accounting for about 14% of the European market. The growth is driven by increasing consumer awareness of health and beauty, alongside a rising middle class. Regulatory policies are evolving to support product safety and efficacy. Key cities like Moscow and St. Petersburg are central to market dynamics, with a competitive landscape featuring both local and international players aiming to capture the growing demand for innovative solutions.

Italy : Strong Demand for Natural Ingredients

Italy's nutricosmetics market is valued at $350.0 million, representing approximately 16% of the European market. The growth is driven by a rich heritage in beauty and a strong consumer preference for natural ingredients. Regulatory policies are increasingly focused on sustainability and product transparency. Major cities like Milan and Rome are key markets, with a competitive landscape that includes both established brands and innovative startups, catering to a diverse consumer base.

Spain : Focus on Local Ingredients and Wellness

Spain's nutricosmetics market is valued at $250.0 million, making up about 11% of the European market. The growth is driven by a focus on local ingredients and wellness-oriented products. Regulatory frameworks are adapting to support the burgeoning market, ensuring product safety and efficacy. Key cities like Barcelona and Madrid are central to market activities, with a competitive landscape featuring both local and international brands that cater to unique consumer preferences.

Rest of Europe : Emerging Opportunities Across Regions

The Rest of Europe nutricosmetics market is valued at $496.03 million, accounting for about 22% of the total market. Growth is driven by diverse consumer preferences and increasing health consciousness across various countries. Regulatory policies vary, impacting product development and marketing strategies. Key markets include Scandinavia and Eastern Europe, where local players and international brands compete to meet the rising demand for innovative and effective nutricosmetic solutions.