Increasing Consumer Awareness

The growing awareness among consumers regarding the benefits of nutricosmetics is a pivotal driver for the nutricosmetics market in Japan. As individuals become more informed about the relationship between nutrition and skin health, they are increasingly seeking products that offer both beauty and wellness benefits. This trend is reflected in the rising sales of nutricosmetic products, which have seen an increase of approximately 15% in the last year alone. The emphasis on preventive health measures has led consumers to prioritize products that enhance their overall appearance and well-being. Consequently, this heightened awareness is likely to propel the nutricosmetics market further, as consumers actively seek out innovative solutions that align with their health and beauty goals.

Growing Interest in Holistic Wellness

The rising interest in holistic wellness is emerging as a crucial driver for the nutricosmetics market in Japan. Consumers are increasingly adopting a comprehensive approach to health that encompasses physical, mental, and emotional well-being. This trend is reflected in the growing popularity of nutricosmetic products that not only enhance beauty but also promote overall health. The market is witnessing a shift towards products that incorporate functional ingredients known for their health benefits, such as antioxidants and vitamins. This holistic perspective is likely to contribute to a projected growth rate of 12% in the nutricosmetics market over the next few years, as consumers seek products that align with their wellness-oriented lifestyles.

Rising Demand for Personalized Nutrition

The trend towards personalized nutrition is emerging as a significant driver for the nutricosmetics market in Japan. Consumers are increasingly seeking tailored solutions that cater to their specific skin and health needs. This shift is prompting brands to offer customized nutricosmetic products, which may include personalized vitamin blends or targeted formulations based on individual skin types. The market for personalized nutrition is anticipated to grow by 20% in the coming years, reflecting a broader consumer desire for products that resonate with their unique health profiles. This demand for personalization is likely to reshape the nutricosmetics market, encouraging innovation and differentiation among brands.

Technological Advancements in Product Development

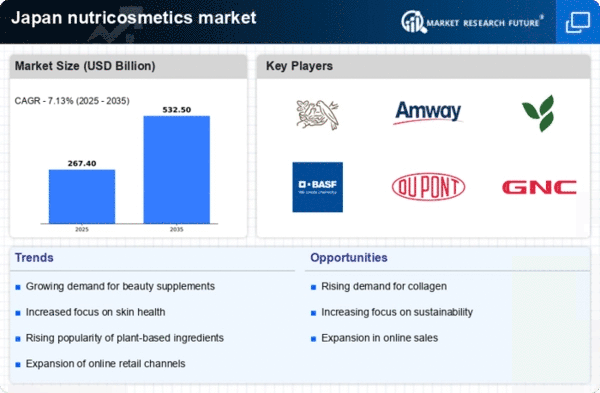

Technological innovations in the formulation and delivery of nutricosmetic products are significantly influencing the nutricosmetics market in Japan. Advances in biotechnology and food science have enabled the development of more effective and targeted formulations, enhancing the efficacy of these products. For instance, the incorporation of bioactive compounds and improved absorption techniques has led to a surge in consumer interest. The market is projected to grow at a CAGR of 10% over the next five years, driven by these advancements. As companies invest in research and development, the introduction of novel ingredients and formulations is expected to attract a broader consumer base, thereby expanding the nutricosmetics market.

Influence of Social Media and Celebrity Endorsements

The impact of social media and celebrity endorsements on consumer purchasing behavior is a notable driver for the nutricosmetics market in Japan. As influencers and celebrities promote nutricosmetic products, they significantly shape consumer perceptions and preferences. This trend has led to a marked increase in product visibility and desirability, particularly among younger demographics. Recent studies indicate that approximately 60% of consumers are influenced by social media when making beauty-related purchases. Consequently, brands are increasingly leveraging these platforms to engage with consumers, thereby enhancing their market presence. This dynamic is expected to continue driving growth in the nutricosmetics market as brands adapt to the evolving landscape of digital marketing.