Expansion of E-commerce Channels

The rapid expansion of e-commerce channels is transforming the retail landscape for the nutricosmetics market in China. With the increasing penetration of the internet and mobile devices, consumers are turning to online platforms for their beauty and wellness needs. E-commerce sales of beauty products in China are projected to account for over 30% of total sales by 2025. This shift not only provides convenience for consumers but also allows brands to reach a wider audience. Consequently, the nutricosmetics market is poised to benefit from this trend as more consumers opt for online shopping.

Increasing Consumer Awareness of Skin Health

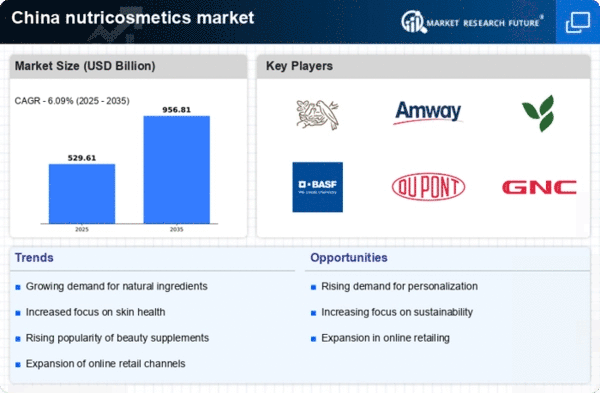

The growing awareness among consumers regarding skin health is a pivotal driver for the nutricosmetics market. As individuals become more informed about the impact of nutrition on skin appearance, the demand for products that promote skin health through dietary supplements is likely to rise. In China, the market for nutricosmetics is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This trend indicates that consumers are increasingly seeking solutions that combine beauty and health, thereby propelling the nutricosmetics market forward.

Rising Demand for Natural and Organic Products

The shift towards natural and organic products is significantly influencing the nutricosmetics market in China. Consumers are increasingly concerned about the ingredients in their beauty products, leading to a preference for formulations that are free from synthetic additives. This trend is evident as the market for organic beauty products in China is expected to grow at a CAGR of 12% over the next five years. The nutricosmetics market is benefiting from this demand, as brands are focusing on sourcing high-quality, natural ingredients that appeal to health-conscious consumers.

Growing Interest in Preventive Health Solutions

The rising interest in preventive health solutions is a significant driver for the nutricosmetics market in China. As consumers become more proactive about their health and well-being, there is an increasing demand for products that offer preventive benefits, such as anti-aging and skin rejuvenation. This trend is reflected in the growing sales of dietary supplements that promote skin health, which are expected to increase by 15% annually. The nutricosmetics market is likely to thrive as consumers seek out innovative products that align with their preventive health goals.

Influence of Social Media and Celebrity Endorsements

Social media platforms and celebrity endorsements play a crucial role in shaping consumer perceptions and driving sales in the nutricosmetics market. In China, the rise of influencers and beauty bloggers has created a new avenue for brands to reach potential customers. This trend is particularly impactful among younger demographics, who are more likely to trust recommendations from social media figures. As a result, brands are increasingly investing in digital marketing strategies to enhance their visibility and credibility, which is likely to contribute to the growth of the nutricosmetics market.