Culinary Diversity

Culinary diversity plays a pivotal role in shaping the Tortilla Market. As global cuisines become more accessible, consumers are increasingly experimenting with various types of tortillas, including corn, flour, and specialty varieties. The rise of ethnic restaurants and food trucks has further popularized diverse tortilla applications, from tacos to wraps. Market data indicates that the demand for specialty tortillas, such as those infused with herbs or spices, is on the rise, reflecting a broader trend towards unique flavor experiences. This culinary exploration suggests that the Tortilla Market could benefit from expanding its product lines to include innovative flavors and textures, appealing to adventurous eaters and food enthusiasts alike. The potential for growth in this segment may drive competition and encourage brands to differentiate themselves through unique offerings.

Health-Conscious Choices

The Tortilla Market is experiencing a notable shift towards health-conscious choices among consumers. As individuals increasingly prioritize nutrition, the demand for whole grain and gluten-free tortillas has surged. According to recent data, the market for gluten-free products is projected to grow at a compound annual growth rate of 9.5% over the next five years. This trend indicates that manufacturers are likely to innovate and diversify their product offerings to cater to health-oriented consumers. Additionally, the rise of plant-based diets has led to an increased interest in tortillas made from alternative ingredients such as chickpeas and lentils. This evolution in consumer preferences suggests that the Tortilla Market must adapt to meet the growing demand for healthier options, potentially reshaping the competitive landscape.

Sustainability and Innovation

Sustainability is becoming increasingly important within the Tortilla Market, as consumers express a preference for environmentally friendly products. The demand for organic and sustainably sourced ingredients is rising, prompting manufacturers to adopt eco-friendly practices in their production processes. Recent statistics indicate that the organic tortilla segment is expected to witness a growth rate of 7% annually, reflecting a shift towards more responsible consumption. Additionally, innovations in packaging, such as biodegradable materials, are gaining traction as brands seek to reduce their environmental footprint. This focus on sustainability not only aligns with consumer values but also presents an opportunity for the Tortilla Market to enhance brand loyalty and attract environmentally conscious consumers. As sustainability becomes a key differentiator, companies that prioritize eco-friendly practices may find themselves at a competitive advantage.

Cultural Influence and Globalization

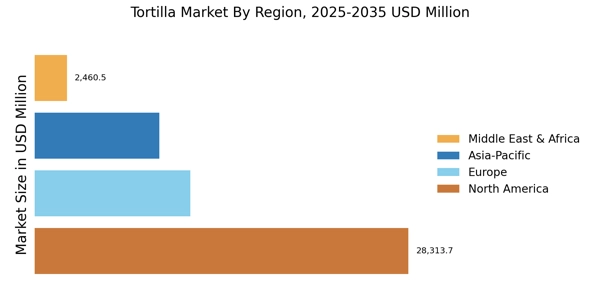

Cultural influence and globalization are significantly impacting the Tortilla Market. As cultures blend and culinary traditions intermingle, the popularity of tortillas is expanding beyond traditional boundaries. The increasing availability of international cuisines in various regions has led to a heightened interest in tortillas as versatile food items. Market analysis indicates that the demand for tortillas in non-traditional markets is growing, driven by the rising popularity of Mexican and Latin American cuisines. This cultural exchange suggests that the Tortilla Market may experience growth opportunities in regions where tortillas were previously less common. As consumers become more adventurous in their food choices, the potential for market expansion appears promising, encouraging brands to explore new markets and adapt their offerings to local tastes.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of modern consumers is driving the Tortilla Market towards convenience and on-the-go consumption. With an increasing number of individuals seeking quick meal solutions, ready-to-eat tortilla products are gaining popularity. Data suggests that the demand for pre-packaged tortilla wraps and snack options is on the rise, as consumers look for convenient meal alternatives that fit their busy schedules. This trend indicates that manufacturers may need to focus on developing portable and easy-to-prepare tortilla products, catering to the needs of time-strapped individuals. Furthermore, the growth of e-commerce platforms has made it easier for consumers to access a variety of tortilla products, enhancing convenience. As the Tortilla Market adapts to these changing consumer behaviors, the emphasis on convenience could lead to new product innovations and marketing strategies.