Expansion of Retail Channels

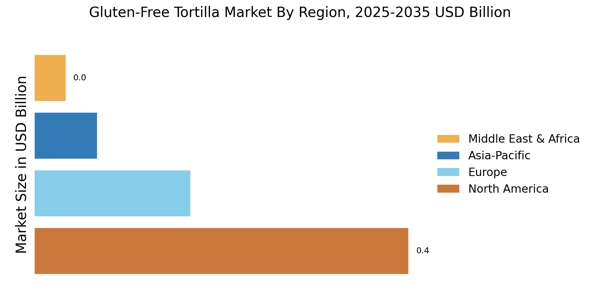

The expansion of retail channels is playing a pivotal role in the growth of the Gluten-Free Tortilla Market. Supermarkets, health food stores, and online platforms are increasingly stocking gluten-free products, making them more accessible to consumers. This trend is particularly evident in regions where gluten-free diets are gaining popularity. Market data suggests that the availability of gluten-free tortillas in mainstream grocery stores has increased significantly, allowing consumers to easily find and purchase these products. Furthermore, the rise of e-commerce has enabled brands to reach a wider audience, catering to the growing demand for gluten-free options. This increased accessibility is likely to drive further growth in the market.

Innovative Ingredient Development

The Gluten-Free Tortilla Market is witnessing a surge in innovative ingredient development, which is crucial for enhancing the texture and taste of gluten-free tortillas. Manufacturers are increasingly experimenting with various flours, such as almond, coconut, and chickpea, to create products that closely mimic traditional tortillas. This innovation is driven by consumer preferences for diverse flavors and textures, as well as the need for high-quality gluten-free alternatives. Market data indicates that the segment of gluten-free tortillas made from alternative ingredients is projected to grow significantly, as consumers seek products that not only meet dietary restrictions but also offer unique culinary experiences. This trend suggests a promising future for the industry, as it adapts to evolving consumer tastes.

Increased Awareness of Health Benefits

There is a growing awareness among consumers regarding the health benefits associated with gluten-free diets, which is positively impacting the Gluten-Free Tortilla Market. Research indicates that many individuals perceive gluten-free products as healthier options, even if they do not have gluten intolerance. This perception is driving sales, as consumers are increasingly seeking out gluten-free tortillas as part of a balanced diet. Additionally, the rise of social media and health influencers has further amplified this awareness, leading to a broader acceptance of gluten-free products in mainstream diets. As a result, the market for gluten-free tortillas is expected to expand, with more brands entering the space to meet this rising demand.

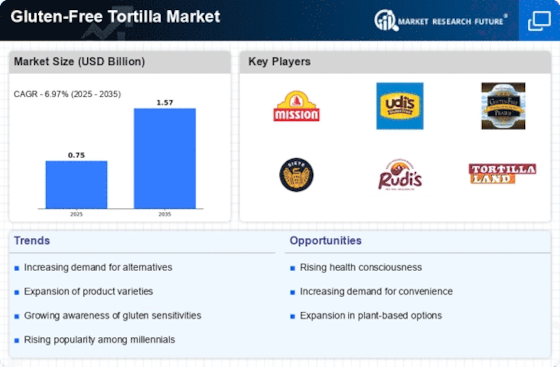

Rising Demand for Gluten-Free Products

The increasing prevalence of celiac disease and gluten sensitivity has led to a notable rise in the demand for gluten-free products, including those in the Gluten-Free Tortilla Market. According to recent estimates, approximately 1% of the population is diagnosed with celiac disease, while a larger segment of the population opts for gluten-free diets for perceived health benefits. This trend is expected to continue, as more consumers become aware of gluten-related health issues. Consequently, manufacturers are responding by expanding their gluten-free product lines, which includes tortillas made from alternative grains such as corn, rice, and quinoa. This shift not only caters to those with dietary restrictions but also appeals to health-conscious consumers seeking nutritious options.

Consumer Preference for Clean Label Products

The trend towards clean label products is influencing the Gluten-Free Tortilla Market, as consumers become more discerning about the ingredients in their food. There is a marked preference for products that are free from artificial additives, preservatives, and allergens. This shift is prompting manufacturers to reformulate their gluten-free tortillas to align with clean label standards, which often emphasize transparency and simplicity in ingredient lists. Market Research Future indicates that consumers are willing to pay a premium for clean label gluten-free products, reflecting a broader trend towards health and wellness. As this preference continues to grow, it is likely to shape the future offerings within the gluten-free tortilla segment.