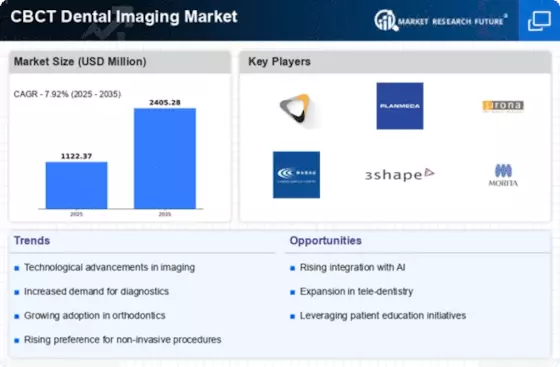

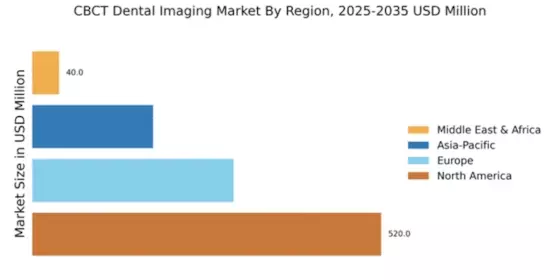

The CBCT Dental Imaging Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for precise diagnostic imaging in dental practices. Key players such as Carestream Dental (US), Planmeca (FI), and Sirona Dental Systems (US) are at the forefront, each adopting distinct strategies to enhance their market presence. Carestream Dental (US) focuses on innovation, particularly in integrating AI capabilities into their imaging systems, which appears to enhance diagnostic accuracy and streamline workflows. Meanwhile, Planmeca (FI) emphasizes regional expansion, having recently increased its footprint in Asia, which suggests a strategic move to tap into emerging markets with growing dental care needs. Sirona Dental Systems (US) is also notable for its partnerships with dental schools, indicating a commitment to education and training, which may foster brand loyalty among future practitioners.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and optimize supply chains. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive environment encourages innovation and responsiveness to market demands, as smaller firms often look to differentiate themselves through niche offerings or specialized technologies.

In January 2026, Vatech (KR) announced the launch of a new CBCT system that incorporates advanced imaging algorithms designed to reduce radiation exposure while maintaining high image quality. This strategic move not only aligns with the growing emphasis on patient safety but also positions Vatech (KR) as a leader in technological innovation within the market. The introduction of such a system could potentially attract a broader customer base, particularly among practitioners who prioritize patient care.

In December 2025, 3Shape (DK) unveiled a partnership with a leading dental software provider to enhance its imaging solutions with integrated digital workflows. This collaboration is indicative of a broader trend towards digital transformation in the dental sector, suggesting that 3Shape (DK) is keen on providing comprehensive solutions that streamline the entire dental treatment process. Such strategic alliances may enhance their competitive edge by offering more value to customers through integrated services.

In November 2025, Morita (JP) expanded its product line by introducing a compact CBCT unit aimed at smaller dental practices. This move reflects an understanding of market needs, particularly the demand for space-efficient solutions in urban settings. By catering to this segment, Morita (JP) could potentially capture a niche market that is often overlooked by larger competitors, thereby enhancing its market position.

As of February 2026, the competitive trends in the CBCT Dental Imaging Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing product offerings and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based strategies to a focus on innovation, technological advancements, and supply chain reliability. This shift may redefine how companies position themselves in the market, emphasizing the importance of delivering superior value through cutting-edge solutions.