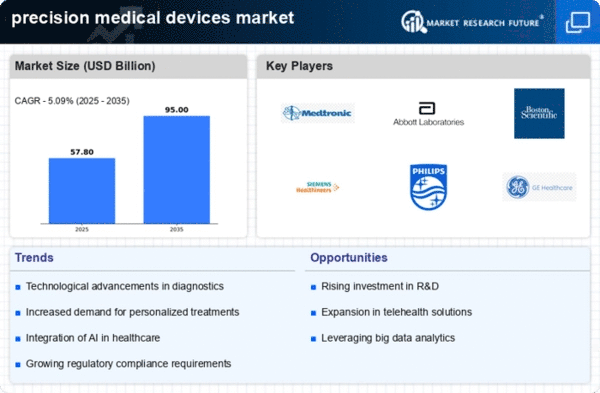

The precision medical devices market is characterized by a dynamic competitive landscape, driven by technological advancements, increasing healthcare demands, and a growing emphasis on personalized medicine. Major players such as Medtronic (US), Abbott (US), and Siemens Healthineers (DE) are strategically positioned to leverage innovation and expand their market presence. Medtronic (US) focuses on enhancing its product portfolio through continuous innovation, particularly in minimally invasive surgical devices, while Abbott (US) emphasizes its strength in diagnostics and cardiovascular devices. Siemens Healthineers (DE) is investing heavily in digital health solutions, indicating a shift towards integrated healthcare systems.

Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological prowess and the ability to meet diverse patient needs.Key business tactics within the precision medical devices market include localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness. The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of key players shapes competitive dynamics, as they engage in strategic partnerships and collaborations to bolster their capabilities and expand their reach.

In November Medtronic (US) announced a strategic partnership with a leading AI firm to develop advanced predictive analytics tools for surgical procedures. This collaboration aims to enhance surgical outcomes by providing real-time data insights, thereby positioning Medtronic (US) at the forefront of digital transformation in surgical care. The strategic importance of this move lies in its potential to improve patient safety and operational efficiency, aligning with the growing trend towards data-driven healthcare solutions.

In October Abbott (US) launched a new line of continuous glucose monitoring systems designed for personalized diabetes management. This product introduction not only reinforces Abbott's commitment to innovation but also addresses the increasing demand for patient-centric solutions in chronic disease management. The strategic significance of this launch is underscored by the potential to capture a larger share of the diabetes care market, which is experiencing rapid growth due to rising prevalence rates.

In September Siemens Healthineers (DE) unveiled a new telehealth platform aimed at enhancing remote patient monitoring capabilities. This initiative reflects a broader trend towards digital health solutions, enabling healthcare providers to deliver care more efficiently. The strategic relevance of this platform lies in its ability to facilitate continuity of care, particularly in a landscape where remote healthcare services are becoming increasingly vital.

As of December current competitive trends in the precision medical devices market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are increasingly shaping the landscape, as companies recognize the need for collaborative approaches to innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological innovation, supply chain reliability, and the ability to deliver personalized healthcare solutions. This shift underscores the importance of adaptability and forward-thinking strategies in navigating the complexities of the precision medical devices market.