North America : Innovation Hub for Medical Tech

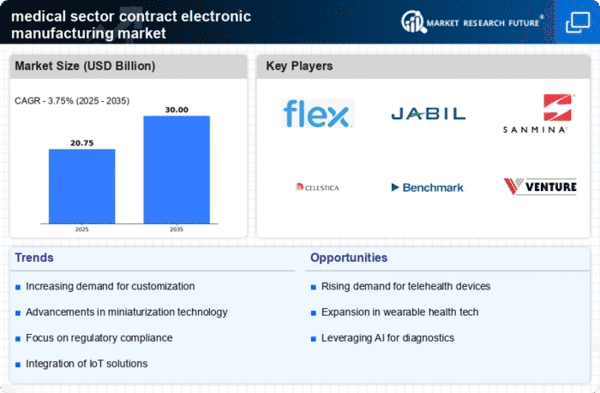

North America dominates the medical sector contract electronic manufacturing market, holding a significant share of 10.0 in 2025. The region benefits from advanced healthcare infrastructure, high R&D investments, and a growing demand for innovative medical devices. Regulatory support from agencies like the FDA further catalyzes market growth, ensuring compliance and safety in manufacturing processes. The increasing prevalence of chronic diseases drives the need for advanced medical technologies, propelling market expansion. The competitive landscape in North America is robust, featuring key players such as Flex Ltd, Jabil Inc, and Sanmina Corporation. The U.S. stands out as the leading country, contributing significantly to the market size. Companies are focusing on strategic partnerships and technological advancements to enhance their service offerings. The presence of established firms and a skilled workforce fosters an environment conducive to innovation and growth in the medical manufacturing sector.

Europe : Emerging Powerhouse in Manufacturing

Europe's medical sector contract electronic manufacturing market is poised for growth, with a market size of 5.0 in 2025. The region is driven by stringent regulatory frameworks and a focus on quality assurance, which enhance consumer trust and safety. The increasing demand for personalized medicine and advanced healthcare solutions is a key growth driver. Additionally, government initiatives aimed at boosting healthcare technology investments are expected to further stimulate market expansion. Leading countries in Europe include Germany, the UK, and France, with Germany being a manufacturing powerhouse. The competitive landscape features companies like Kreuzer and Celestica, which are investing in innovative technologies to meet market demands. The presence of a skilled workforce and strong R&D capabilities positions Europe as a significant player in The medical sector contract electronic manufacturing market. "The European medical technology market is expected to grow significantly, driven by innovation and regulatory support," European Commission report states.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region is witnessing rapid growth in the medical sector contract electronic manufacturing market, with a size of 4.0 in 2025. Factors such as increasing healthcare expenditure, a rising aging population, and advancements in technology are driving demand. Countries like China and India are investing heavily in healthcare infrastructure, which is expected to boost the market. Additionally, favorable government policies and initiatives aimed at enhancing healthcare access are contributing to market growth. China is the leading country in this region, with a burgeoning manufacturing sector. The competitive landscape includes key players like Venture Corporation Limited and NexLogic Technologies, who are focusing on expanding their capabilities. The region's growth is further supported by collaborations between local firms and international companies, enhancing innovation and market reach. The Asia-Pacific market is set to become a significant contributor to the global medical manufacturing landscape.

Middle East and Africa : Resource-Rich Frontier for Growth

The Middle East and Africa (MEA) region is emerging as a resource-rich frontier in the medical sector contract electronic manufacturing market, with a size of 1.0 in 2025. The growth is driven by increasing healthcare investments and a rising demand for medical devices. Governments in the region are focusing on improving healthcare infrastructure and regulatory frameworks, which are essential for attracting foreign investments and enhancing local manufacturing capabilities. The growing prevalence of lifestyle diseases is also pushing the demand for advanced medical technologies. Countries like South Africa and the UAE are leading the way in developing their medical manufacturing sectors. The competitive landscape is evolving, with local firms and international players seeking to establish a foothold in the region. The presence of key players is gradually increasing, and partnerships are being formed to leverage local resources and expertise. The MEA region is on the cusp of significant growth in the medical manufacturing market.