Growing Geriatric Population

The demographic shift towards an aging population in North America is a critical driver for the Cbct Dental Imaging Market. As the geriatric population continues to grow, there is an increasing prevalence of dental issues that require advanced imaging for effective diagnosis and treatment. CBCT technology offers detailed imaging that is essential for complex cases often seen in older patients, such as implant planning and assessment of bone quality. Market projections indicate that the demand for CBCT imaging systems will rise in tandem with the aging population, potentially increasing market revenues by 20% by 2026. This demographic trend highlights the necessity for advanced imaging solutions in geriatric dental care.

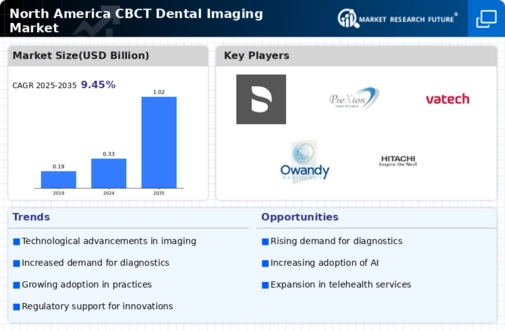

Rising Demand for Dental Imaging

The North America Cbct Dental Imaging Market is experiencing a notable increase in demand for advanced dental imaging solutions. This surge is primarily driven by the growing awareness among patients regarding oral health and the importance of accurate diagnostics. As dental professionals seek to enhance treatment planning and improve patient outcomes, the adoption of Cone Beam Computed Tomography (CBCT) technology is becoming more prevalent. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is indicative of a broader trend towards precision dentistry, where accurate imaging plays a crucial role in treatment success.

Supportive Reimbursement Policies

The North America Cbct Dental Imaging Market benefits from supportive reimbursement policies that encourage the adoption of advanced imaging technologies. Insurance providers are increasingly recognizing the value of CBCT imaging in enhancing diagnostic accuracy and treatment outcomes. As reimbursement for CBCT procedures becomes more favorable, dental practices are more likely to invest in this technology. Recent data indicates that approximately 60% of dental insurance plans now cover CBCT imaging, which is expected to further increase as awareness of its benefits grows. This supportive environment is likely to drive market growth, making advanced imaging more accessible to both practitioners and patients.

Increased Focus on Preventive Care

The North America Cbct Dental Imaging Market is witnessing a shift towards preventive care, which is significantly influencing the demand for advanced imaging technologies. Dental professionals are increasingly recognizing the value of early detection of dental issues, which can be facilitated by CBCT imaging. This proactive approach not only enhances patient care but also reduces long-term treatment costs. As a result, the market for CBCT systems is projected to expand, with estimates indicating a potential increase in market size by 15% over the next few years. This trend underscores the importance of imaging technologies in preventive dental care.

Integration of Digital Technologies

The integration of digital technologies within the North America Cbct Dental Imaging Market is transforming traditional dental practices. The advent of digital workflows, including the use of CBCT imaging, allows for enhanced visualization and analysis of dental structures. This technological shift not only improves diagnostic accuracy but also streamlines the overall workflow in dental clinics. As practices increasingly adopt digital solutions, the demand for CBCT systems is expected to rise. Market data suggests that the penetration of digital imaging technologies in dental practices is likely to reach over 70% by 2026, further solidifying the role of CBCT in modern dentistry.