Regulatory Developments

Regulatory developments play a pivotal role in shaping the UK CBCT dental imaging market. The UK government, through its health agencies, has established guidelines that ensure the safety and efficacy of dental imaging technologies. Compliance with these regulations is essential for manufacturers and practitioners alike. The introduction of stringent quality control measures has led to an increase in the reliability of CBCT systems. Furthermore, the UK government has been actively promoting the use of digital imaging technologies in dental practices, which is likely to drive market growth. As regulations evolve, they may encourage further innovation and investment in the UK CBCT dental imaging market, fostering a competitive landscape that benefits both practitioners and patients.

Increased Awareness of Oral Health

Increased awareness of oral health among the UK population is driving growth in the CBCT dental imaging market. As individuals become more informed about the importance of dental care, there is a corresponding rise in demand for advanced diagnostic tools. Educational campaigns and public health initiatives have contributed to this heightened awareness, leading to more patients seeking comprehensive dental evaluations. Consequently, dental practices are investing in CBCT technology to meet this demand. Recent surveys indicate that approximately 60% of patients are now more likely to choose practices that utilize advanced imaging techniques. This trend suggests that the UK CBCT dental imaging market will continue to thrive as practitioners adapt to the evolving expectations of informed patients.

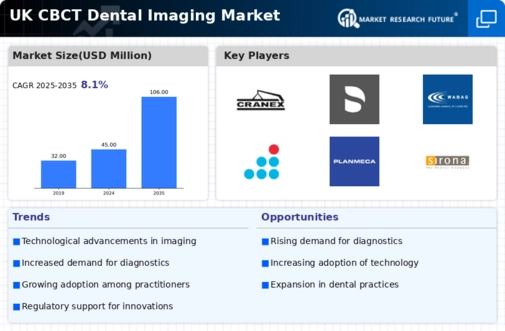

Technological Advancements in Imaging

The UK CBCT dental imaging market is experiencing rapid technological advancements that enhance diagnostic capabilities. Innovations such as improved image resolution and reduced radiation exposure are becoming standard. For instance, the introduction of high-definition CBCT systems allows for more accurate assessments of dental structures, which is crucial for treatment planning. The market is projected to grow as dental practitioners increasingly adopt these advanced imaging technologies. According to recent data, the adoption rate of CBCT systems in the UK has increased by approximately 30% over the past five years, indicating a strong trend towards modern imaging solutions. This shift not only improves patient outcomes but also positions the UK CBCT dental imaging market as a leader in dental diagnostics.

Growing Demand for Precision Dentistry

The growing demand for precision dentistry is significantly influencing the UK CBCT dental imaging market. Patients are increasingly seeking personalized treatment plans that require detailed imaging for accurate diagnosis. This trend is reflected in the rising number of dental practices incorporating CBCT technology into their services. Market data suggests that the demand for precision dentistry has led to a 25% increase in CBCT system installations across the UK in recent years. As dental professionals recognize the value of precise imaging in enhancing treatment outcomes, the UK CBCT dental imaging market is likely to expand further. This shift towards precision is not only beneficial for patient care but also positions the UK as a hub for advanced dental practices.

Integration of CBCT with Digital Workflow

The integration of CBCT with digital workflows is transforming the UK CBCT dental imaging market. As dental practices increasingly adopt digital technologies, the synergy between CBCT imaging and digital planning tools enhances treatment efficiency. This integration allows for seamless data transfer between imaging systems and treatment planning software, improving the overall patient experience. Market analysis indicates that practices utilizing integrated digital workflows report a 20% increase in operational efficiency. Furthermore, this trend is likely to attract more dental professionals to invest in CBCT technology, as it streamlines processes and reduces turnaround times for treatment planning. The UK CBCT dental imaging market stands to benefit from this integration, as it aligns with the broader movement towards digitalization in healthcare.