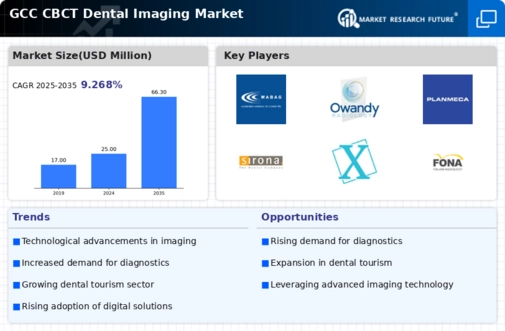

The GCC CBCT dental imaging market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for precise diagnostic tools. Key players such as Carestream Dental (AE), Planmeca Oy (FI), and Sirona Dental Systems (DE) are at the forefront, each adopting distinct strategies to enhance their market presence. Carestream Dental (AE) focuses on innovation, particularly in integrating AI capabilities into their imaging systems, which appears to enhance diagnostic accuracy and streamline workflows. Meanwhile, Planmeca Oy (FI) emphasizes regional expansion, having recently established partnerships with local distributors to penetrate emerging markets within the GCC. Sirona Dental Systems (DE) is also notable for its commitment to digital transformation, investing heavily in R&D to develop next-generation imaging solutions that cater to evolving customer needs. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological innovation and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure is moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of products and services, catering to different customer preferences and needs. The collective influence of these key players fosters a competitive atmosphere where innovation and quality are paramount.

In November 2025, Carestream Dental (AE) announced the launch of a new AI-driven imaging software that significantly reduces the time required for image processing. This strategic move is likely to position the company as a leader in efficiency, appealing to dental practices seeking to enhance patient throughput without compromising diagnostic quality. The integration of AI not only streamlines operations but also aligns with the broader trend of digitalization in healthcare.

In December 2025, Planmeca Oy (FI) expanded its product line by introducing a new CBCT unit designed specifically for pediatric patients. This initiative reflects the company's strategic focus on niche markets, potentially capturing a segment that has been underserved in the past. By tailoring products to specific demographics, Planmeca Oy (FI) may enhance its competitive edge and foster customer loyalty.

In January 2026, Sirona Dental Systems (DE) entered into a strategic partnership with a leading software developer to enhance its imaging solutions with advanced analytics capabilities. This collaboration is indicative of a trend towards integrating data analytics into imaging technologies, which could provide practitioners with deeper insights into patient conditions. Such partnerships are likely to redefine competitive dynamics, as companies that leverage data effectively may gain a substantial advantage.

As of January 2026, the competitive trends in the GCC CBCT dental imaging market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are becoming more prevalent, shaping the landscape as companies seek to combine strengths and innovate collaboratively. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge.