Increased Focus on Patient-Centric Care

In the Japan CBCT dental imaging market, there is a notable shift towards patient-centric care, which is influencing the adoption of advanced imaging technologies. Dental practitioners are increasingly recognizing the importance of providing comprehensive and accurate diagnostics to improve patient outcomes. This trend is supported by the growing awareness among patients regarding the benefits of advanced imaging techniques, such as reduced radiation exposure and enhanced treatment planning. As a result, dental practices are investing in CBCT systems that align with this patient-centric approach, contributing to the overall growth of the market.

Rising Demand for Orthodontic Treatments

The Japan CBCT dental imaging market is witnessing a rising demand for orthodontic treatments, which is driving the adoption of advanced imaging technologies. As more individuals seek orthodontic solutions, the need for precise imaging to assess dental structures and plan treatments becomes paramount. CBCT imaging provides orthodontists with three-dimensional views of the dental anatomy, facilitating better treatment outcomes. Market data indicates that the orthodontic segment is expected to account for a significant share of the overall dental imaging market in Japan, further propelling the growth of CBCT systems in the industry.

Regulatory Support for Innovative Solutions

The Japan CBCT dental imaging market benefits from robust regulatory support that encourages the adoption of innovative imaging solutions. The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan has established guidelines that facilitate the approval process for new imaging technologies. This regulatory environment fosters a climate of innovation, allowing manufacturers to introduce cutting-edge CBCT systems that meet the evolving needs of dental professionals. As a result, the market is likely to see an influx of advanced imaging solutions that enhance diagnostic accuracy and treatment planning, thereby driving growth in the industry.

Technological Advancements in Imaging Systems

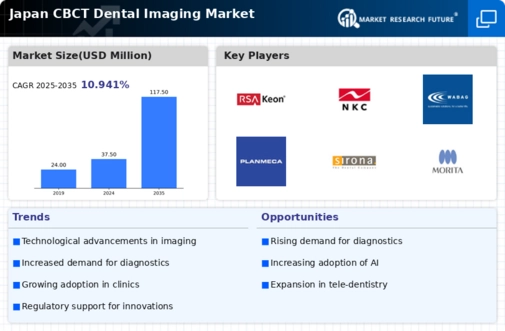

The Japan CBCT dental imaging market is experiencing a surge in technological advancements that enhance imaging quality and efficiency. Innovations such as high-resolution detectors and advanced software algorithms are enabling practitioners to obtain clearer and more detailed images. This is particularly relevant in Japan, where the demand for precise diagnostics is high. According to recent data, the market for dental imaging systems in Japan is projected to grow at a compound annual growth rate of approximately 8% over the next five years. These advancements not only improve diagnostic capabilities but also streamline workflows in dental practices, making them more efficient and patient-friendly.

Integration of Digital Technologies in Dentistry

The integration of digital technologies in the Japan CBCT dental imaging market is transforming traditional dental practices. The shift towards digital workflows, including the use of electronic health records and digital imaging, is enhancing the efficiency and accuracy of dental diagnostics. CBCT systems are increasingly being integrated with other digital tools, such as CAD/CAM systems, to streamline treatment planning and execution. This trend is likely to continue, as dental professionals in Japan seek to improve patient experiences and outcomes through the adoption of comprehensive digital solutions, thereby driving growth in the CBCT market.