农业轮胎市场概览:

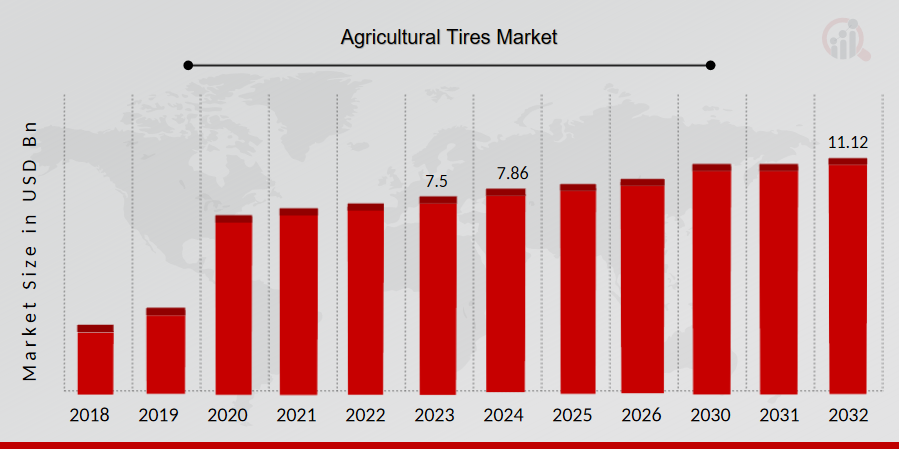

p2023 年农业轮胎市场规模价值 75 亿美元。预计农业轮胎行业将从 2024 年的 78.6 亿美元增长到 2032 年的 111.2 亿美元,预测期内(2024 - 2030 年)的复合年增长率 (CAGR) 为 4.48%。对高效和高产农业机械最终产品的需求增加以及先进技术在农业中的日益普及是促进市场增长的关键市场驱动力。

来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

农业轮胎市场趋势

h3拖拉机需求增长推动市场增长 p大多数发展中国家的人口从农村向城市迁移、劳动力成本上升以及熟练劳动力的缺乏推动了拖拉机的销售。农场劳动力短缺和成本上升是农业行业市场复合年增长率上升的主要原因。预计在预测期内,对运营效率的需求不断增加以及劳动力成本的上升将推动农业轮胎市场的收入。农业拖拉机市场将受到有限劳动力供应的驱动。考虑到简单的供需经济学和劳动力从城市向农村的转移,农业劳动力成本与一个国家从事农业的总人口比例直接相关。因此,农场主投资农场设备以减少对人力的依赖,减少农业所需的时间和精力。农民越来越多地投资于较少劳动力的设备以达到最佳生产力。

虽然这些设备类型的初始投资很高,但它们有助于提高作物的整体质量和数量。许多农民正在缩减农业经营规模,并出租部分农场以抵消不断上涨的劳动力成本。随着越来越多的农民减少对劳动力的依赖,预计未来几年拖拉机销量将健康增长,从而推动预测期内对拖拉机轮胎的需求。

此外,农业车辆用于农场和农业领域,执行主要的日常作业。车辆用于农业作业,例如,用于作物耕作和侦察、用于选择岩石、用于灌溉等等。如今,大多数工作都是使用这种机械在田间完成的,这导致轮胎需要定期更换,预计这将在预测期内推动农业轮胎市场的增长。

农业轮胎市场细分洞察

h3农业轮胎类型洞察 p根据类型,农业轮胎市场细分包括斜交轮胎和子午线轮胎。斜交轮胎市场占据主导地位;斜交轮胎在印度和中国市场占有很高的份额,因为这些轮胎采用天然橡胶制造,而天然橡胶主要产自这两个国家。此外,斜交轮胎的交叉结构及其低成本供应可能会刺激其需求。原材料成本低廉,进而降低了产品的制造成本。然而,天然橡胶供应的减少可能会抑制该领域的增长。此外,天然橡胶会增加轮胎的刚性,导致轮胎在使用后失去均匀性,影响轮胎的圆形度并缩短其保质期。子午线轮胎采用钢丝帘布层制造,这提高了耐用性,同时采用与周向中心线成90度角的胎圈到胎圈结构,这增加了轮胎的柔韧性并降低了滚动阻力,从而提高了性能。这可能会在预测期内推动农业车辆对子午线轮胎的需求。由于合成橡胶和现代制造技术需要高成本的机械,子午线轮胎的成本很高。

图 1:农业轮胎市场,按轮胎类型划分,2024 年和2030 年(十亿美元)

来源:二手研究、一手研究、MRFR 数据库和分析师评论

农业轮胎应用洞察

p根据应用,农业轮胎市场细分包括拖拉机、联合收割机、喷雾器、拖车、装载机等。拖拉机细分市场占据了主导地位。大马力的拖拉机受到广泛青睐,因为它们可以用于不同的农业活动。因此,随着拖拉机的普及和使用率的提高,轮胎的需求也在增长。由于多种类型的收割机为满足农业需求而推出,预计收割机领域对农用轮胎的需求将会增长。例如,约翰迪尔推出了作物专用收割机,以满足农民的需求,使甘蔗和玉米等作物的收割变得更加容易。这导致对用于大片农场的收割机的需求增加。

农业轮胎销售渠道洞察

p根据销售渠道,农业轮胎市场数据包括原始设备制造商 (OEM) 和售后市场。原始设备制造商 (OEM) 占据了市场主导地位。对于拖拉机和收割机等新型农业车辆而言,通过原始设备制造商 (OEM) 渠道获得的农用轮胎需求正在增加。发达经济体对这些车辆的需求很高,因为农民可以负担得起新引进的昂贵农用设备,这些设备有助于在大片土地上开展农活。由于在线、授权经销商和第三方经销商等不同类型平台的存在,预计通过售后市场渠道对新轮胎的需求将会增长。2021 年 4 月:米其林推出了其 Agribib Row Crop IF(改进的弯曲度)农业轮胎,专为自走式和拖拉式喷雾器设计,可提高负载能力、增强牵引力并减少土壤收缩。

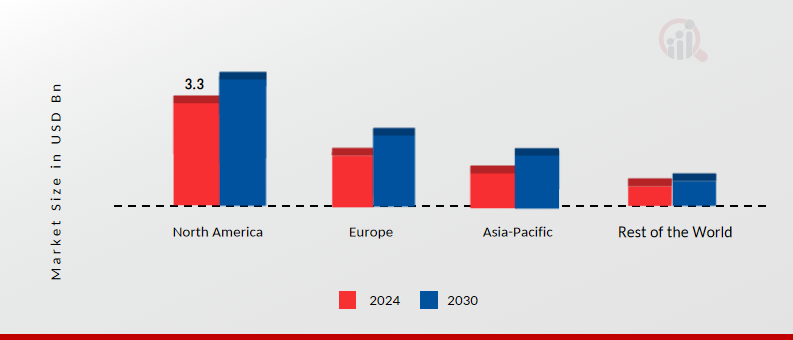

农业轮胎区域洞察

p按地区划分,该研究提供了对北美、欧洲、亚太地区和世界其他地区的市场洞察。北美农业轮胎市场将主导这一市场;农业设备的升级和农业产业的演变,有助于现代综合农业活动的增长,将推动该地区的市场增长。此外,市场报告中研究的主要国家是美国、加拿大、德国、法国、英国、意大利、西班牙、中国、日本、印度、澳大利亚、韩国和巴西。

图 2:2024 年各地区农业轮胎市场份额(%)

来源:二手研究、一手研究、MRFR 数据库和分析师评论

欧洲农业轮胎市场占由于政府的资金支持和低利率等优惠政策促进了农业部门的扩张,欧洲农业轮胎市场占据第二大市场份额。此外,德国农业轮胎市场占有最大的市场份额,英国农业轮胎市场是欧洲地区增长最快的市场。

预计亚太农业轮胎市场在 2024 年至 2030 年期间的复合年增长率最快。这是因为用于生产斜交轮胎的制造技术和材料确保了低成本的高负载能力。制造斜交轮胎所需的主要原材料是天然橡胶。因此,该地区丰富的天然橡胶供应促进了市场增长。此外,中国农业轮胎市场占有最大的市场份额,印度农业轮胎市场是亚太地区增长最快的市场。

农业轮胎主要市场参与者 竞争洞察

p领先的市场参与者正在大力投资研发,以扩大其产品线,这将有助于农业轮胎市场进一步增长。市场参与者也在开展各种战略活动来扩大其影响力,重要的市场发展包括新产品发布、合同协议、并购、增加投资以及与其他组织的合作。农业/农用轮胎行业必须提供具有成本效益的产品,才能在竞争更激烈、不断增长的市场环境中扩张和生存。在本地生产以最大限度地降低运营成本是农业轮胎行业制造商用来造福客户和扩大市场部门的关键商业策略之一。近年来,农业轮胎行业为农业部门提供了一些最重要的优势。农业轮胎市场的主要参与者包括普利司通公司、大陆集团、巴拉克里希纳工业有限公司、泰坦国际公司、特瑞堡公司、米其林、诺基亚轮胎有限公司、倍耐力等C SpA、Alliance Tire Group、Apollo Tyres 等公司正试图通过投资研发业务来增加市场需求。

特瑞堡是一家专注于聚合物技术的工程集团,总部位于瑞典特瑞堡,拥有 21,230 名员工,截至 2021 年的年收入为 338 亿瑞典克朗。该公司于 1964 年首次上市,并作为大盘股在纳斯达克斯德哥尔摩交易所交易。特瑞堡是工程聚合物解决方案领域的全球领导者,其解决方案可在严苛环境中密封、减震和保护关键应用。其创新的解决方案以可持续的方式提升客户的性能。

特瑞堡是工程聚合物解决方案领域的全球领导者,其解决方案可在严苛环境中密封、减震和保护关键应用。其创新的解决方案以可持续的方式提升客户的性能。特瑞堡宣布计划提高其北美农业轮胎工厂的产量,以满足不断增长的需求。该公司18%的车轮销售额来自北美市场。

米其林是一家法国跨国轮胎制造公司,总部位于法国奥弗涅-罗纳-阿尔卑斯大区的克莱蒙费朗。它是仅次于普利司通的第二大轮胎制造商,规模超过固特异和大陆集团。作为领先的轮胎公司,米其林致力于通过制造和销售适用于各种交通工具(包括飞机、汽车、自行车/摩托车、推土机、农用设备和卡车)的轮胎及相关服务,持续改善货物和人员的出行。

此外,米其林还提供数字出行支持服务,并出版旅游指南、酒店和餐厅指南、地图以及道路地图集。米其林推出了 Agribib Row Crop IF(改进的弯曲度)农业轮胎,专为自走式和拖拉式喷雾器设计,具有更高的负载能力、更好的牵引力并减少了土壤收缩。

农业轮胎市场的主要公司包括

ul- 大陆集团

- 巴拉克里希纳工业有限公司

- 泰坦国际公司

- 特瑞堡公司

- 米其林

- 诺基亚轮胎有限公司

- 倍耐力C SpA

- Alliance Tire Group

- 和 Apollo Tyres

2021年12月:特瑞堡公司宣布计划提高其北美农业轮胎工厂的产量,以满足日益增长的需求。该公司18%的车轮销售额来自北美市场。

农业轮胎市场细分

h3农业轮胎类型展望 ul- 斜交轮胎

- 子午线轮胎

- 联合收割机收割机

- 喷雾器

- 拖车

- 装载机

- 其他

- 原始设备制造商

- 售后市场

- 美国

- 加拿大

- 德国

- 法国

- 英国

- 意大利

- 西班牙

- 其余部分欧洲

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 澳大利亚

- 亚太地区其他地区

- 中东

- 非洲

- 拉丁美洲

FAQs

What is the current valuation of the Agricultural Tires Market as of 2024?

The Agricultural Tires Market was valued at 8.212 USD Billion in 2024.

What is the projected market size for the Agricultural Tires Market by 2035?

The market is projected to reach 13.3 USD Billion by 2035.

What is the expected CAGR for the Agricultural Tires Market during the forecast period 2025 - 2035?

The expected CAGR for the Agricultural Tires Market during 2025 - 2035 is 4.48%.

Which companies are considered key players in the Agricultural Tires Market?

Key players include John Deere, Titan International, Trelleborg, BKT, Goodyear, Michelin, Continental, Bridgestone, and Pirelli.

What are the two main types of agricultural tires in the market?

The two main types of agricultural tires are Bias Tires and Radial Tires.

What was the market valuation for Bias Tires in 2024?

The market valuation for Bias Tires was between 3.5 and 5.5 USD Billion in 2024.

Research Approach

Secondary Research

The secondary research process involved comprehensive analysis of tire industry regulatory databases, agricultural machinery publications, trade statistics, and authoritative industry organizations. Key sources included the U.S. Department of Transportation (DOT) and National Highway Traffic Safety Administration (NHTSA) for tire safety standards and regulations; European Tyre and Rubber Manufacturers Association (ETRMA) and Tire Industry Association (TIA) for industry production data and market trends; Japan Automobile Tire Manufacturers Association (JATMA) and China Rubber Industry Association (CRIA) for Asia-Pacific market intelligence; Food and Agriculture Organization (FAO) and USDA National Agricultural Statistics Service for agricultural mechanization trends and farm equipment data; Association of Equipment Manufacturers (AEM) and CEMA (European Agricultural Machinery Association) for OEM production statistics; International Organization for Standardization (ISO) and ASTM International for tire specification standards; U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) for environmental compliance and sustainable material regulations; OECD Agricultural Statistics and EU Eurostat for agricultural machinery fleet data; and national ministries of agriculture and transport from key markets including India, Brazil, and China. These sources were used to collect tire production volumes, agricultural machinery sales data, regulatory compliance requirements, raw material pricing trends, and replacement cycle analysis for radial tires, bias tires, and specialty agricultural tire technologies.

Primary Research

Qualitative and quantitative insights were obtained by interviewing supply-side and demand-side stakeholders during the primary research process. The supply-side sources consisted of CEOs, VPs of Manufacturing, R&D heads, and commercial directors from agricultural tire manufacturers (including Michelin, Bridgestone, Goodyear, Continental, Trelleborg, BKT), OEM strategy heads from agricultural machinery manufacturers (John Deere, CNH Industrial, AGCO Corporation), and raw material suppliers (natural rubber and synthetic polymer producers). Fleet managers from large-scale agricultural operations and cooperatives, procurement heads from equipment rental companies, aftermarket distributors and dealers, agricultural contractors, and tire service providers in key farming regions were all included in the demand-side sources. Our primary research has confirmed OEM fitment agreements and replacement timelines, validated market segmentation between radial and bias tire adoption, and collected insights on soil compaction reduction technologies, pricing strategies for premium versus budget segments, and seasonal demand fluctuations.

Primary Respondent Breakdown:

By Company Tier: Tier 1 (38%), Tier 2 (35%), Tier 3 (27%)

By Designation: C-level Primaries (32%), Director Level (33%), Others (35%)

By Region: North America (38%), Europe (29%), Asia-Pacific (24%), Rest of World (9%)

[Note: Tier 1 = >USD 10B revenue; Tier 2 = USD 1B-10B; Tier 3 =

Market Size Estimation

Global market valuation was derived through revenue mapping and equipment fitment analysis. The methodology included:

Identification of over 50 significant tire manufacturers and OEMs in North America, Europe, Asia-Pacific, and Latin America

Product mapping across radial tires, bias tires, and specialty agricultural tire categories segmented by tractor, combine harvester, sprayer, and trailer applications

Analysis of reported and modeled annual revenues specific to agricultural tire portfolios, including OEM fitment volumes and aftermarket replacement cycles

Coverage of manufacturers representing 75-80% of global market share in 2024

Extrapolation using bottom-up (agricultural machinery sales × tire fitment rates × replacement cycles by country/region) and top-down (manufacturer revenue validation and import/export trade data reconciliation) approaches to derive segment-specific valuations for OEM and aftermarket channels

请填写以下表格以获取本报告的免费样本

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”