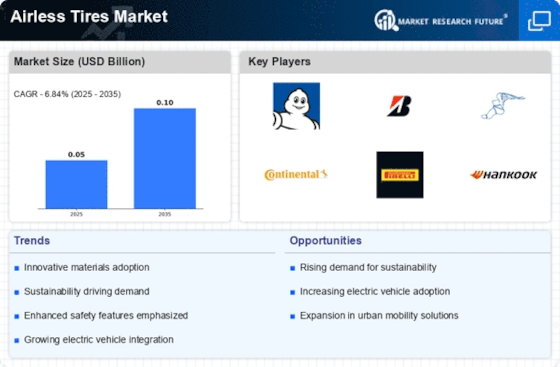

The Airless Tires Market is currently characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as Michelin (FR), Bridgestone (JP), and Goodyear (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Michelin (FR) emphasizes innovation through its development of advanced materials and designs aimed at improving performance and durability. Bridgestone (JP) focuses on sustainability, integrating eco-friendly practices into its manufacturing processes, while Goodyear (US) is leveraging digital transformation to optimize its supply chain and enhance customer engagement. Collectively, these strategies not only foster competition but also push the boundaries of technological advancement within the market. In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and improve supply chain efficiency. This approach appears to be a response to the growing demand for airless tires across various regions, particularly in urban areas where sustainability is a priority. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial, shaping trends and consumer preferences. In August 2025, Michelin (FR) announced the launch of its new airless tire prototype designed specifically for electric vehicles. This strategic move is significant as it aligns with the global shift towards electric mobility, positioning Michelin as a leader in the sustainable tire segment. The innovation not only enhances the performance of electric vehicles but also addresses environmental concerns, potentially attracting a broader customer base. In September 2025, Bridgestone (JP) unveiled its partnership with a leading automotive manufacturer to co-develop airless tire technology tailored for autonomous vehicles. This collaboration is crucial as it underscores Bridgestone's commitment to innovation and positions the company to capitalize on the burgeoning autonomous vehicle market. By integrating airless tire technology into autonomous systems, Bridgestone may enhance safety and efficiency, thereby solidifying its competitive edge. In July 2025, Goodyear (US) expanded its production capabilities by investing in a new facility dedicated to the manufacturing of airless tires. This expansion is indicative of Goodyear's strategic focus on meeting the increasing demand for innovative tire solutions. By enhancing production capacity, Goodyear is likely to improve its market responsiveness and strengthen its supply chain reliability, which is essential in a competitive landscape. As of October 2025, current trends in the Airless Tires Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming increasingly prevalent, as companies recognize the value of collaboration in driving innovation and enhancing market reach. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition to a focus on technological innovation, sustainability, and supply chain reliability. This transition may redefine market dynamics, compelling companies to innovate continuously to maintain their competitive positions.