Agricultural Tires Size

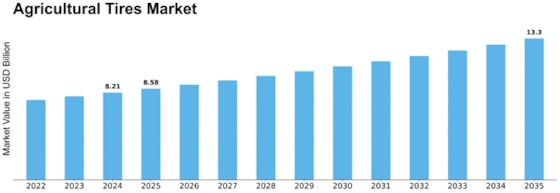

Agricultural Tires Market Growth Projections and Opportunities

The global demand for agricultural tractors is on the rise, driven by the increasing need for efficient agricultural practices. Projections indicate that the global agricultural tractors market is set to achieve a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period from 2022 to 2030. In 2021, Asia-Pacific emerged as the dominant region, commanding a substantial 54% share of the global agricultural tractors market. Following closely were North America and Europe, with shares of 21.7% and 13.5%, respectively.

The market for agricultural tractors worldwide is categorized based on several factors, including engine power, application, type, operation, and driver type. Engine power classifications include below 40 HP, 40 HP–120 HP, 121 HP–180 HP, 181 HP–250 HP, and more than 250 HP. The 40 HP–120 HP segment is anticipated to experience the highest growth during the forecast period. In 2021, it accounted for a significant 27.4% share of the global agricultural tractors market.

The application of these tractors is diverse, with segments such as harvesting, seed sowing, irrigation, and others. Among these, the harvesting segment is expected to witness the most substantial growth in the coming years, holding a notable 33.7% share in 2021.

The types of agricultural tractors are classified into Internal Combustion Engine (ICE) and electric. The electric segment is projected to exhibit faster growth during the forecast period, capturing a 19.3% share of the global agricultural tractors market in 2021.

When considering the operational aspect, agricultural tractors are categorized into manual tractor vehicles and autonomous tractor vehicles. The autonomous tractor vehicle segment is anticipated to witness the highest growth rate during the forecast period, securing a 17.7% share in the global market in 2021.

Furthermore, the driver type of agricultural tractors is segmented into 2-wheel drive and 4-wheel drive. The 4-wheel drive segment is expected to experience faster growth during the forecast period, holding a substantial 32.4% share in 2021.

The global market for agricultural tractors is undergoing significant growth, driven by the imperative for increased agricultural efficiency. The diverse segmentation of the market, including engine power, application, type, operation, and driver type, provides insights into the specific trends and preferences shaping the industry. As the demand for agricultural tractors continues to rise, particularly in regions like Asia-Pacific, the market is poised for notable expansion, offering opportunities for manufacturers and stakeholders alike.

Leave a Comment