Expansion of Esports and Competitive Gaming

The rise of esports and competitive gaming has significantly impacted the Gaming Console Market. With millions of viewers and participants, esports events have created a lucrative ecosystem for console manufacturers. Data suggests that the audience for esports is expanding rapidly, with projections indicating a potential reach of over 600 million viewers by 2025. This growth is prompting console makers to develop products tailored for competitive gaming, including specialized controllers and performance-enhancing features. As the popularity of esports continues to rise, it is likely to drive sales and engagement within the Gaming Console Market, attracting both casual and professional gamers.

Advancements in Online Multiplayer Capabilities

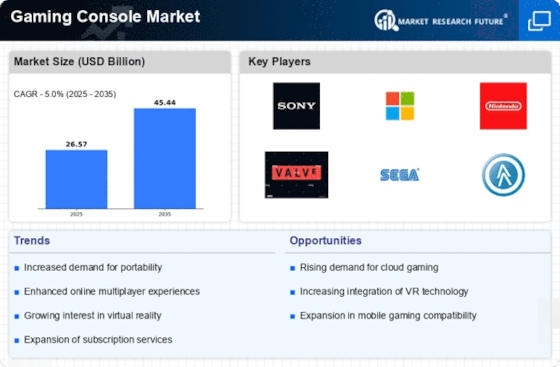

The evolution of online multiplayer gaming is transforming the Gaming Console Market. Enhanced connectivity and improved online services are enabling gamers to engage with others worldwide, fostering a sense of community. Recent statistics reveal that a significant portion of gamers prefers online multiplayer experiences, which has prompted console manufacturers to enhance their online platforms. Features such as cross-platform play and cloud gaming integration are becoming increasingly important. As these advancements continue to evolve, they are likely to attract a broader audience to the Gaming Console Market, driving growth and encouraging innovation among manufacturers.

Growing Demand for Immersive Gaming Experiences

The Gaming Console Market is witnessing a surge in demand for immersive gaming experiences. As technology advances, consumers increasingly seek consoles that offer high-definition graphics, virtual reality capabilities, and enhanced audio. This trend is reflected in the sales data, which indicates that consoles with advanced features are outperforming their predecessors. The integration of augmented reality and virtual reality into gaming consoles is becoming a focal point for manufacturers, as they aim to provide users with unparalleled experiences. This growing demand is likely to drive innovation and competition within the Gaming Console Market, pushing companies to invest in research and development to meet consumer expectations.

Increased Availability of Exclusive Game Titles

Exclusive game titles remain a pivotal driver in the Gaming Console Market. Major console manufacturers are investing heavily in securing exclusive rights to popular game franchises, which can significantly influence consumer purchasing decisions. Recent data indicates that consoles with a robust library of exclusive titles tend to achieve higher sales figures. This strategy not only enhances brand loyalty but also encourages gamers to choose specific consoles over others. As the competition intensifies, the availability of exclusive titles is expected to play a crucial role in shaping the dynamics of the Gaming Console Market, potentially leading to shifts in market share among leading brands.

Rising Popularity of Subscription-Based Gaming Services

Subscription-based gaming services are emerging as a key driver in the Gaming Console Market. These services offer gamers access to a vast library of games for a monthly fee, appealing to a diverse audience. Recent trends indicate that subscription models are gaining traction, with many consumers preferring the flexibility and variety they provide. This shift is prompting console manufacturers to adapt their offerings, integrating subscription services into their platforms. As the popularity of these services continues to grow, they are expected to reshape consumer behavior and purchasing patterns within the Gaming Console Market, potentially leading to increased sales and engagement.