Top Industry Leaders in the Gaming Console Market

The Contenders Clash: Exploring the Competitive Landscape of the Gaming Console Market

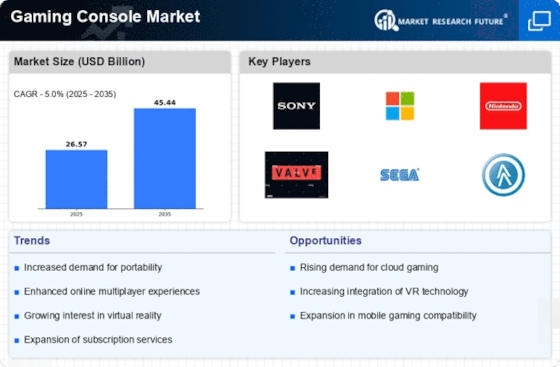

The gaming console market, projected to reach a staggering Value by 2024, is a vibrant arena where established giants and agile newcomers fight for a controller hold. From powerful hardware to captivating exclusives, players duke it out in a battle for market share, captivating the hearts and wallets of devoted gamers. Understanding the key combatants, their strategies, and the metrics governing victory is crucial for anyone navigating this dynamic battlefield.

Key Players:

- Sony Corporation (Japan)

- Microsoft Corporation (US)

- Nintendo Co. Ltd. (Japan)

- Logitech Inc. (Switzerland)

- Valve Corporation (US)

- NVIDIA Corporation (US)

- PlayJam (UK)

Strategies for Gaming Glory:

-

Hardware Innovation: Pushing the boundaries of processing power, graphics fidelity, and controller designs remains a critical battleground. Each player attempts to outdo the other with faster frame rates, immersive visuals, and unique features like haptic feedback.

-

Exclusive Games: Securing exclusive titles from talented developers is a key weapon. Sony's God of War and Microsoft's Forza Horizon serve as prime examples, locking in dedicated fans and driving console sales.

-

Subscriptions & Services: Online multiplayer, downloadable content, and cloud gaming subscriptions are becoming increasingly important revenue streams. Offering diverse subscription tiers and attractive services like PlayStation Plus and Xbox Game Pass is crucial for player retention and recurring revenue.

-

Evolving Business Models: Experimenting with new models like cloud gaming and hybrid subscription/hardware purchase options allows companies to cater to diverse preferences and expand their reach.

Market Share Analysis & Key Metrics:

-

Console Unit Sales: The total number of consoles sold remains a fundamental metric, reflecting a brand's overall popularity and market dominance.

-

Average Selling Price (ASP): Measuring the average price at which consoles are sold indicates a brand's premium positioning and revenue generation potential.

-

Active User Base: The number of active console users, as opposed to simply sold units, reflects engagement and potential revenue from subscriptions and game purchases.

-

Game Library Breadth & Exclusives: The size and quality of a brand's game library, particularly the presence of exclusive titles, directly impacts consumer purchase decisions and market share.

New Frontiers & Emerging Trends:

-

Cloud Gaming's Rise: The ability to stream AAA games without expensive hardware opens up gaming to new audiences and potentially disrupts traditional console ownership models.

-

Virtual Reality & Augmented Reality (VR/AR): Integration of VR/AR experiences into console offerings opens up new gameplay possibilities and immersive experiences, further blurring the lines between physical and digital entertainment.

-

Mobile Gaming Convergence: Consoles are increasingly incorporating mobile gaming features, offering cross-play options and blurring the lines between console and mobile experiences.

-

Focus on Accessibility & Inclusivity: Diverse controller options, improved accessibility features, and family-friendly content are becoming priorities, expanding the gaming audience and fostering inclusivity.

Investment Trends & The Road Ahead:

-

Cloud Gaming Infrastructure: Investing in robust cloud infrastructure and expanding game libraries is crucial for cloud gaming platforms to become viable alternatives to traditional consoles.

-

VR/AR Development: Building compelling VR/AR experiences and hardware specifically designed for consoles will be key to driving adoption and user engagement.

-

Partnerships & Acquisitions: Collaboration with game developers, content creators, and technology providers will be crucial for expanding game libraries, acquiring talent, and accessing new technologies.

-

Focus on Value & Subscriptions: Offering diverse subscription tiers, free-to-play options, and bundling services with hardware purchases will be key to attracting and retaining a loyal user base.

The gaming console market is a dynamic battlefield, constantly evolving as players adapt to new trends and technologies. Understanding the key competitors, their strategies, and the factors shaping market share will be crucial for anyone seeking to gain a foothold in this exciting arena. By focusing on innovation, captivating experiences, and adapting to a changing landscape, the victors in this contest will be the ones who captivate the hearts and minds of gamers for generations to come.

This comprehensive overview should provide you with a solid understanding of the competitive landscape in the gaming console market. Remember, staying informed about the latest trends and adapting your strategies will be key to thriving in this ever-evolving battleground.

Latest Company Updates:

- Sony PlayStation 5 Pro: Rumors abound about a potential PlayStation 5 Pro console with upgraded hardware for even better performance.

- Microsoft Xbox Series S Price Cut: Microsoft has announced a price cut for the Xbox Series S, making it a more attractive option for budget-conscious gamers.

- Nintendo Switch OLED Model: The Nintendo Switch OLED model offers a brighter and more vibrant display compared to the original Switch.