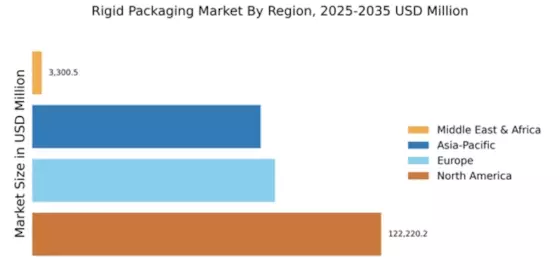

North America : Market Leader in Rigid Packaging

North America continues to lead the rigid packaging market, holding a significant share of 122220.21. The growth is driven by increasing demand for sustainable packaging solutions and stringent regulations promoting eco-friendly materials. The region's advanced manufacturing capabilities and technological innovations further bolster market expansion. Additionally, the rise in e-commerce and food delivery services has heightened the need for durable packaging solutions, contributing to robust market dynamics. The United States is the primary contributor to this market, with key players like Amcor, Berry Global, and Sealed Air leading the charge. The competitive landscape is characterized by continuous innovation and strategic partnerships aimed at enhancing product offerings. Companies are increasingly focusing on sustainable practices, aligning with consumer preferences for environmentally friendly packaging. This competitive environment ensures that North America remains at the forefront of the rigid packaging industry.

Europe : Emerging Trends in Sustainability

Europe's rigid packaging market, valued at €85000.0, is witnessing a shift towards sustainable practices, driven by regulatory frameworks and consumer demand for eco-friendly solutions. The European Union's stringent regulations on plastic waste and recycling are catalyzing innovation in packaging materials. This focus on sustainability is expected to propel market growth, as companies adapt to meet these evolving standards and consumer preferences for greener options. Leading countries in this region include Germany, France, and the UK, where major players like Mondi Group and Crown Holdings are actively investing in sustainable technologies. The competitive landscape is marked by collaborations and acquisitions aimed at enhancing product portfolios. As the market evolves, companies are prioritizing the development of recyclable and biodegradable packaging solutions, positioning Europe as a leader in sustainable rigid packaging.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of $80000.0, is experiencing rapid growth in the rigid packaging sector, driven by urbanization and rising disposable incomes. The demand for packaged food and beverages is surging, leading to increased investments in packaging technologies. Additionally, government initiatives promoting manufacturing and exports are further stimulating market growth, making this region a key player in the global landscape. Countries like China, India, and Japan are at the forefront of this expansion, with significant contributions from local and international players. Companies such as Sealed Air and Sonoco Products are enhancing their presence through strategic partnerships and innovations. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share in this dynamic environment.

Middle East and Africa : Untapped Potential in Packaging

The Middle East and Africa (MEA) region, with a market size of $3300.49, presents untapped potential in the rigid packaging market. The growth is primarily driven by increasing demand for packaged goods and a burgeoning retail sector. Additionally, government initiatives aimed at diversifying economies and enhancing manufacturing capabilities are fostering a conducive environment for market expansion. The region's young population and rising urbanization are also contributing to the demand for innovative packaging solutions. Leading countries in this region include South Africa and the UAE, where key players are beginning to establish a foothold. Companies like Graham Packaging and WestRock are exploring opportunities to cater to the growing market. The competitive landscape is evolving, with both local and international firms seeking to capitalize on the region's growth potential, making MEA a promising market for rigid packaging solutions.