Research Methodology on Rigid Packaging Market

Introduction:

The research methodology for the market report titled "Rigid Packaging Market" focuses on the research techniques implemented for preparing the research report on the said market segment.

The objective of the report is to provide details about the global rigid packaging market; thus, the methodology adopted for the research is designed to help understand the market structure.

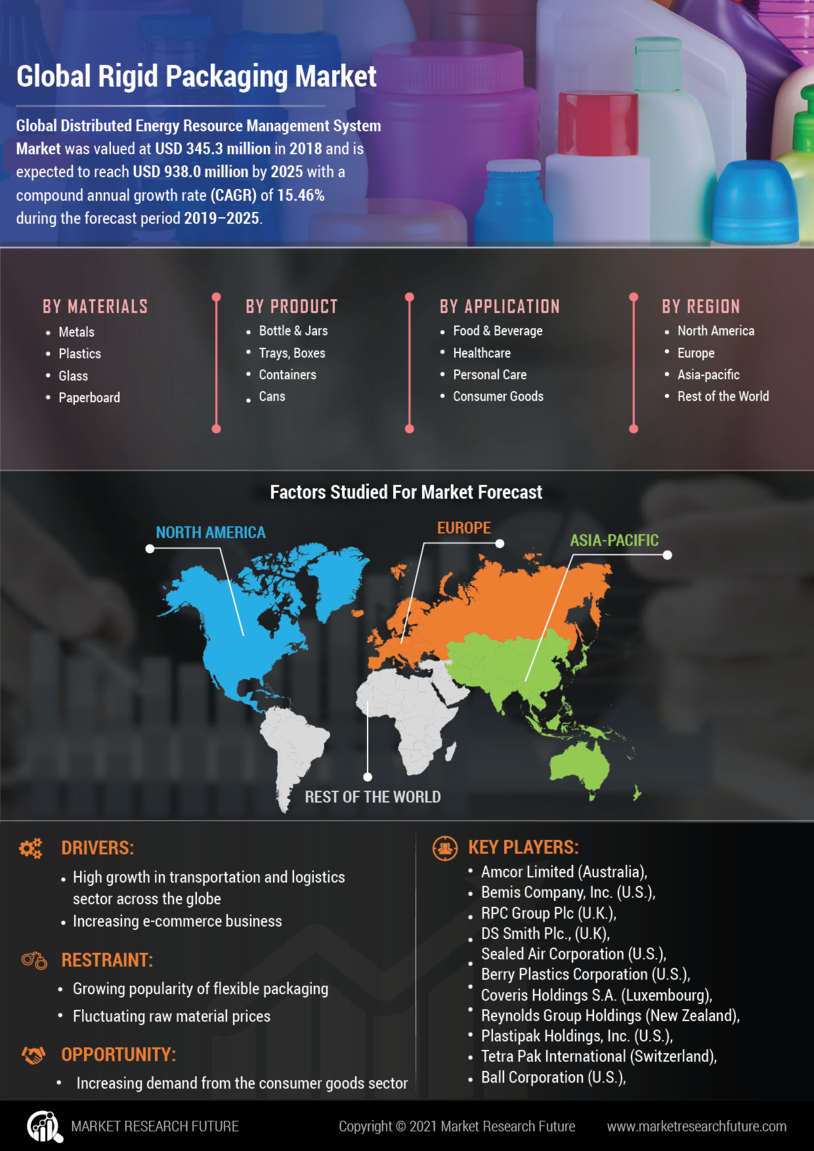

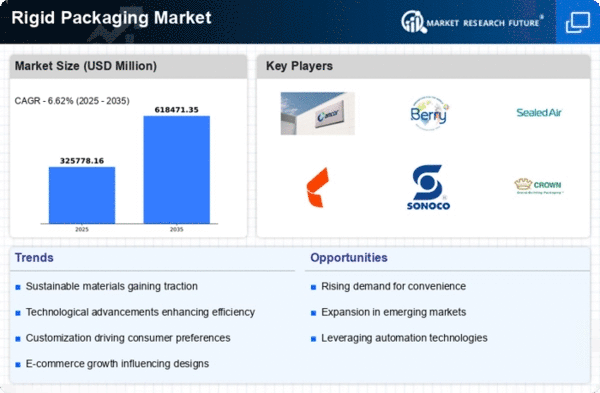

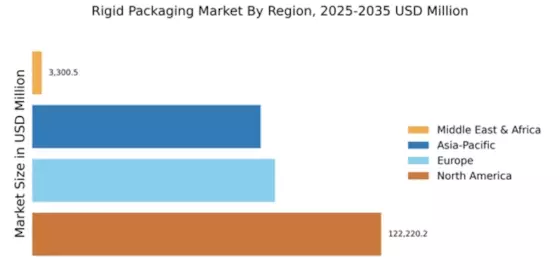

The published research report studies the market's various parameters, the size and growth of the market, the various competitors and their contributions in terms of market share, the opportunities and challenges for the participants, and other dynamic factors that help in building a thriving economic system within the global rigid packaging market.

Research Design:

In order to develop an in-depth understanding of the various aspects of the rigid packaging market, a mixed methods research approach is adopted, which means that both qualitative and quantitative methods are used to understand the nuances of the market. The key techniques used in this research are outlined below:

Secondary Research:

Secondary research is pertinent in understanding the market dynamics and trends and basing the forecast. Primary sources such as industry reports (trade websites, manufacturer's websites, and annual reports) and secondary sources such as primary news sources, libraries and industry associations are used to supplement existing research with reliable and comprehensive data.

Primary Research:

Primary research aims to collect first-hand information or data collected directly from the potential participants. Face-to-face and telephonic interviews and surveys are conducted to collect objective data from industry experts, including vendors, distributors and end-users, to validate the findings from secondary research further.

Data Collection:

The research methodology consists of in-depth secondary and primary research. The data is collected from various sources, including industry trade shows and conferences, published papers and publications, journals, magazines, and conversations with industry professionals. The sources used in the research are predominantly authentic and comprise a healthy mix of primary and secondary resources.

Assumptions and Limitations:

The research is conducted in the global marketplace, and it is assumed that the market dynamics are not significantly affected by matters in specific regions. A maximum effort is put into compiling the data to maintain accuracy, but due to the rapidly changing nature of the industry, there is a possibility of certain data points having shifted by the time data was collected.

Analysis and Modelling:

The collected data were analyzed using qualitative and quantitative tools to project the market's future trajectory. Other modelling techniques, such as forecasting, are also employed to aid in the understanding of the components that affect the market size.

Drafting of Report:

The final report is drafted based on the research, analysis and modelling results. The inputs from the primary research are included in the report. Careful checks are done to maintain the overall quality of the report.

Conclusion:

This research methodology is used as a base to develop an in-depth understanding of the global rigid packaging market. The research process explained here is efficient and reliable, and the report's conclusions are expected to offer an insightful view to the participants in making informed decisions to seek growth and gain a valuable edge within the global market.