Research Design

The research design adopted to prepare this research report is a qualitative descriptive study. Descriptive research is a type of research that asks a predetermined set of questions and then collects and analyzes data to answer those questions. This study provides a comprehensive overview of the flexible packaging market, with an emphasis on the key trends, opportunities and challenges in the global market.

Data Collection Procedure

Firstly, an in-depth review and analysis of the primary and secondary sources of information are conducted. Primary data consists of interviews with key industry players regarding the current and likely future trends in the market. Secondary data consists of statistics, reports and market data sourced from industry sources and relevant Government publications.

The primary sources of information for the research are interviews conducted with industry experts, market leaders and industry representatives. The interviews cover a wide range of topics such as market trends, challenges and opportunities. This data is gathered in the form of qualitative data and is used to understand the industry trends, challenges and opportunities in the global flexible packaging market.

Data Analysis

Secondary data analysis is also conducted in order to build on the qualitative aspects of the research. The secondary data is analysed using various statistical tools such as regression analysis, factor analysis and cluster analysis. Statistical tools are used to assess the relevance and importance of the data relevant to the study.

The data collected is analysed in order to gain insights into the industry trends, challenges and opportunities in the global flexible packaging market. The data is analysed both qualitatively and quantitatively in order to gain a comprehensive understanding of the industry. The qualitative analysis includes a review of the primary and secondary data sources to develop an industry framework and a review of the key industry trends, challenges and opportunities. The quantitative analysis involves analysis of the quantitative data sources such as financial reports, customer surveys and forecast models.

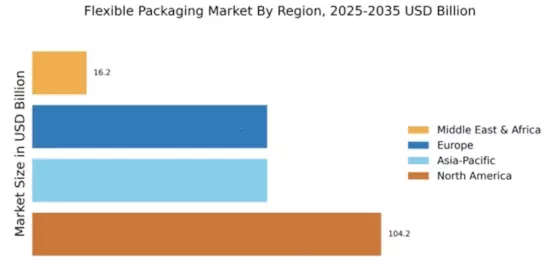

The research findings are presented in the form of tables and charts. The tables and charts are used to represent the key findings from the research on the global flexible packaging market. The tables and charts are presented in a way that allows for easy comparison of the various industry statistics.

Reporting

The research findings are presented in a comprehensive report format with the analysis and recommendations integrated. The report is divided into sections for clarity of the research and ease of reading. The report includes the background, objectives, methodology, findings, conclusions and recommendations.

Conclusion

The study aims to provide a comprehensive overview of the global flexible packaging market. In order to do this, various qualitative and quantitative research methods are employed. This includes a comprehensive review of the primary and secondary sources of information as well as an analysis of quantitative data sources. The study employs a qualitative descriptive research design with interviews conducted with industry players acting as primary sources of data. The research findings are presented in the form of tables and charts in order to make a comparison of the industry data easier. The research findings are presented in a comprehensive report format with the analysis and recommendations integrated.