Market Analysis

In-depth Analysis of Rigid Packaging Market Industry Landscape

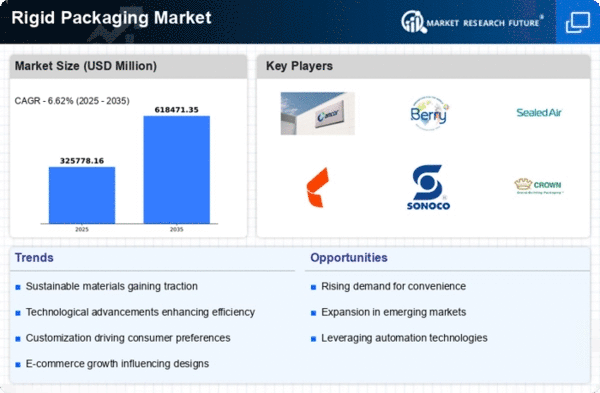

The rigid packaging market is active and vital to many industries, from food and beverage to pharmaceuticals and consumer goods. Many variables shape this market, reflecting client demands, technological advances, and global financial trends. In rigid packaging, consumer preferences drive market factors. Thus, rigid packaging is using more repurposed and biodegradable materials.

Innovation also shapes rigid packaging markets. Materials and assembly techniques have improved, leading to new packaging designs. Lightweight yet powerful materials, high-quality printing, and innovative packaging are becoming more common. These advances improve rigid packaging and store network productivity and cost-viability.

International economic trends and conditions also affect rigid packaging markets. Raw material expenses, exchange methods, and manufacturing network disruptions can effect packaging producers' expense design. Thus, rigid packaging companies must be agile to navigate financial risks and global changes.

The administrative scene is another important rigid packaging industry feature. State-run administrations are tightening packaging, name, and reuse rules. This has led packaging manufacturers to follow these requirements and adopt economic techniques. Companies that proactively handle administrative needs provide consistency and position themselves advantageously in the market by aligning with the growing demand for eco-friendly packaging.

Competitive powers also drive rigid packaging sales. Packaging makers compete for market share. Companies differentiate themselves by product creation, quality, and smart arrangements. Key partnerships, consolidations, and acquisitions are common ways rigid packaging companies strengthen their market position and product portfolios.

Additionally, shifting socioeconomics and lifestyles affect rigid-packaged commodities. As urbanization and living speed up, comfort-focused packaging becomes more popular. Popular single-use and fast-moving packaging has changed packaging design and function. As packaging manufacturers adapt to satisfy the growing needs of a powerful buyer base, this change in customer behavior influences the market elements.

Leave a Comment