E-commerce Growth

The rise of e-commerce has a profound impact on the Rigid Bulk Packaging Market. As online shopping continues to expand, the demand for efficient and durable packaging solutions is increasing. Rigid bulk packaging is favored for its ability to protect products during transit, ensuring they arrive in optimal condition. Recent statistics indicate that e-commerce sales have surged, leading to a corresponding rise in the need for robust packaging solutions. This trend suggests that companies are investing in rigid bulk packaging to enhance customer satisfaction and reduce return rates. Consequently, the Rigid Bulk Packaging Market is poised for growth as it adapts to the evolving needs of the e-commerce sector.

Regulatory Compliance

Regulatory compliance is a critical driver for the Rigid Bulk Packaging Market. Governments worldwide are implementing stringent regulations regarding packaging materials and waste management. These regulations often mandate the use of specific materials that are safe for consumers and the environment. As a result, manufacturers are compelled to innovate and adapt their packaging solutions to meet these legal requirements. The Rigid Bulk Packaging Market is witnessing a shift towards compliance-driven designs, which not only fulfill regulatory standards but also enhance product safety. This trend indicates that companies prioritizing compliance are likely to gain a competitive edge in the market.

Sustainability Initiatives

The Rigid Bulk Packaging Market is increasingly influenced by sustainability initiatives. Companies are adopting eco-friendly materials and practices to meet consumer demand for environmentally responsible products. This shift is evident as many manufacturers are transitioning to recyclable and biodegradable materials, which not only reduce environmental impact but also enhance brand image. According to recent data, the market for sustainable packaging is projected to grow significantly, with a notable increase in demand for rigid bulk packaging solutions that align with these initiatives. As businesses strive to minimize their carbon footprint, the Rigid Bulk Packaging Market is likely to see a surge in innovations aimed at sustainability, potentially reshaping the competitive landscape.

Technological Advancements

Technological advancements are reshaping the Rigid Bulk Packaging Market. Innovations in materials science and manufacturing processes are leading to the development of lighter, stronger, and more efficient packaging solutions. For instance, the introduction of advanced polymers and composites is enhancing the durability and performance of rigid bulk packaging. Additionally, automation in production processes is streamlining operations, reducing costs, and improving consistency in product quality. These advancements suggest that the Rigid Bulk Packaging Market is on the brink of a transformation, where technology plays a pivotal role in meeting the demands of modern consumers and businesses alike.

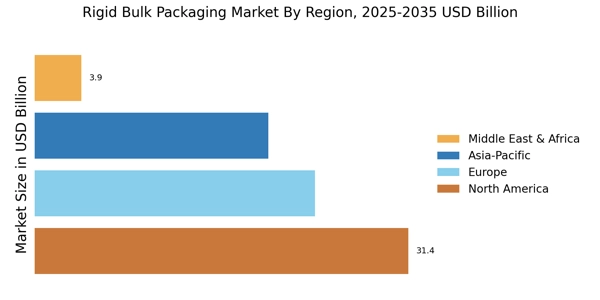

Rising Demand from Emerging Markets

The Rigid Bulk Packaging Market is experiencing rising demand from emerging markets. As economies in these regions grow, there is an increasing need for efficient packaging solutions to support various industries, including food and beverage, pharmaceuticals, and chemicals. The expansion of manufacturing capabilities and infrastructure in these markets is driving the demand for rigid bulk packaging, which is essential for safe transportation and storage. Recent projections indicate that the market in these regions is expected to grow at a faster rate compared to developed markets. This trend suggests that companies focusing on emerging markets may find lucrative opportunities within the Rigid Bulk Packaging Market.