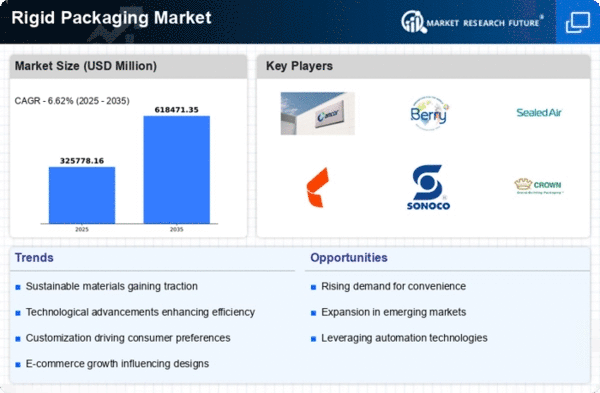

Market Share

Rigid Packaging Market Share Analysis

The rise in working women and the presence of highly paid family members enhances market learning. Changing lifestyles in emerging nations boosts industry growth. Urbanization and more occupied lifestyles boost market growth. Development of items and decreased cooking time increase packaging use. Growth in discretionary cashflow offices and market accommodation drive rigid packaging market size. The Chinese district, Brazilian neighborhood, and others are likely markets.

In the unique Rigid Packaging Market, companies use numerous market share positioning methods to get an edge and identify key business strengths. Separation, when companies distinguish their products from competitors through unique features, marking, or packaging, is common. Companies hope to attract a niche market by delivering creative packaging.

Cost authority, where companies want to be the cheapest, is another crucial process. This includes improving creation processes, collecting materials efficiently, and scaling up. Companies can attract price-sensitive customers and gain market share by offering smart rigid packaging without sacrificing quality. Cost initiative approaches require ongoing functional productivity and development to stay ahead.

Market division is very important in Rigid Packaging Market positioning. Based on topography, industry, and client needs, companies divide the market. Companies can accommodate diverse market demands by tailoring packaging solutions to each segment. This approach customizes marketing and boosts consumer loyalty, increasing market share.

Coordinated effort and important organizations are becoming more popular as companies aim to strengthen their market position. New technologies, distribution channels, and customers can be gained by partnering with related companies. Rigid Packaging Market companies can increase their credibility and market share by leveraging their partners' strengths.

Rigid Packaging market share depends on development. Companies that invest in innovative packaging might attract customers seeking the latest trends. Development, whether it's eco-friendly materials, creative packaging, or new strategies, distinguishes companies and places them as industry leaders, increasing customer loyalty and market share.

Some companies use globalization to expand their markets beyond domestic borders. Rigid Packaging companies can expand their clientele and revenue by entering worldwide markets. However, effective globalization needs a deep understanding of distinct social, administrative, and financial settings and the ability to adapt packaging solutions to other markets.

Leave a Comment