Penetration Testing Size

Market Size Snapshot

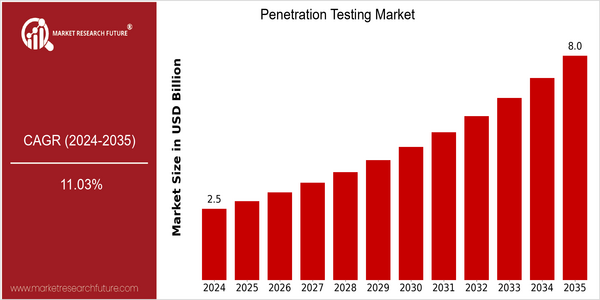

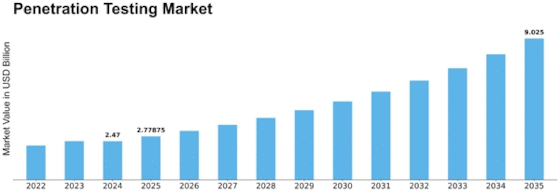

| Year | Value |

|---|---|

| 2024 | USD 2.53 Billion |

| 2035 | USD 8.0 Billion |

| CAGR (2025-2035) | 11.03 % |

Note – Market size depicts the revenue generated over the financial year

The penetration testing market is growing at a high rate. Its current value is $ 2.5 billion in 2024 and is expected to reach $ 8 billion by 2035. This translates into a high CAGR of 11.03% from 2025 to 2035, indicating strong growth in penetration testing services. The increasing frequency and complexity of cyber attacks, coupled with strict regulatory requirements on data protection, are driving this market. The growing awareness of the need for pro-active security measures has increased the penetration testing budgets of companies to identify weaknesses before they can be exploited by malicious actors. Artificial intelligence and machine learning are further enhancing the effectiveness of penetration testing. Rapid7, Tenable and Qualys are at the forefront of this evolution, constantly innovating their offerings and forming strategic alliances to expand their market reach. Recent alliances between security companies and cloud service providers, for example, are aimed at offering comprehensive security solutions for the complexity of modern IT environments. As penetration testing becomes a higher priority for companies, the penetration testing market will continue to grow, backed by technological innovations and the need for increased security.

Regional Market Size

Regional Deep Dive

The penetration testing market is growing at a fast pace across the globe, driven by the increasing cyber threats and the need for robust security measures. In North America, the penetration testing market is characterized by a high rate of adoption of advanced technology and stringent regulatory requirements, while in Europe, the penetration testing market is experiencing a surge in demand due to the implementation of the General Data Protection Regulation (GDPR). Asia-Pacific is the fastest-growing penetration testing market, with an increasing number of organizations realizing the importance of cyber security. The Middle East and Africa are investing heavily in information security, while Latin America is gradually embracing penetration testing as a means of preventing cyber attacks.

Europe

- The implementation of the General Data Protection Regulation (GDPR) has heightened the demand for penetration testing services, as organizations seek to ensure compliance and protect sensitive data.

- Companies such as NCC Group and Trustwave are leading the charge in Europe, offering innovative solutions that address the unique regulatory landscape and security challenges faced by businesses.

Asia Pacific

- Countries like India and Australia are witnessing a surge in cybersecurity awareness, leading to increased investments in penetration testing services as organizations aim to safeguard their digital assets.

- The Australian Cyber Security Centre (ACSC) has launched initiatives to promote cybersecurity best practices, including penetration testing, among businesses to combat rising cyber threats.

Latin America

- As cyber threats become more prevalent, countries like Brazil and Mexico are increasingly adopting penetration testing services to bolster their cybersecurity frameworks.

- Local firms such as Tempest Security Intelligence are gaining traction by offering tailored penetration testing solutions that address the specific needs of businesses in the region.

North America

- The rise of remote work has led to an increased focus on securing remote access points, prompting organizations to invest more in penetration testing services to identify vulnerabilities in their networks.

- Key players like IBM and Rapid7 are expanding their penetration testing offerings, integrating AI and machine learning to enhance threat detection and response capabilities.

Middle East And Africa

- The UAE government has introduced the National Cybersecurity Strategy, which emphasizes the importance of penetration testing in enhancing national security and protecting critical infrastructure.

- Organizations like DarkMatter and Paladion are at the forefront of providing penetration testing services in the region, catering to both public and private sectors.

Did You Know?

“Approximately 60% of small to medium-sized enterprises (SMEs) that experience a cyber attack go out of business within six months, highlighting the critical need for penetration testing.” — Cybersecurity & Infrastructure Security Agency (CISA)

Segmental Market Size

The penetration testing market is a critical part of the broader security market and is currently experiencing robust growth due to increasing cyber threats and regulatory pressures. Penetration testing is increasingly being adopted by companies as a way of addressing the increasing number of breaches and the need to identify and fix security weaknesses. The penetration testing market is also influenced by the increasing number of security breaches and the need to find and fix security weaknesses, as well as by regulations such as the General Data Protection Regulation (GDPR) and HIPAA that require regular penetration testing. Also, the growing trend towards working remotely has increased the need for comprehensive security measures, which in turn has increased the penetration testing market. At the present time, penetration testing is already a mature technology, with the likes of IBM and Rapid7 offering advanced penetration testing solutions in a range of industries, such as finance and healthcare. The main applications of penetration testing are for vulnerability assessment, compliance testing, and security audits. For example, the banking sector uses penetration testing to protect customer data. The penetration testing market is expected to grow strongly over the forecast period as a result of the growing sophistication of cyber-attacks and the digital transformation of the economy. Also, penetration testing is undergoing a process of evolution as a result of the development of new tools and methods. For example, penetration testing is now being carried out using automation tools and artificial intelligence, which makes penetration testing more accurate and time-effective.

Future Outlook

The penetration testing market is set to grow at a CAGR of 11.03% from 2024 to 2035. The increasing frequency and complexity of cyber-attacks, forcing organizations in various industries to take their cyber security measures seriously, is a major driving factor for penetration testing. The penetration testing market is expected to grow significantly with the rise in digital transformation strategies. It is expected that by 2035, nearly 70% of the organizations will have penetration testing as a regular part of their security measures, as compared to about 40% in 2024, indicating a significant shift from reactive to preventive security. Artificial intelligence and machine learning are set to enhance the efficiency and effectiveness of penetration testing. In addition, the compliance and regulatory frameworks, such as the General Data Protection Regulation and the Californian Data Protection Act, are set to drive penetration testing in the coming years. Also, the increasing trend of remote working and the increasing complexity of IT environments are likely to drive penetration testing. Consequently, penetration testing is expected to become a key component of modern cyber security strategies.

Leave a Comment