Asia Pacific Sterility Testing Market Summary

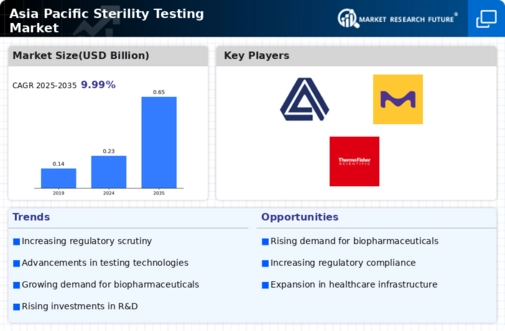

The Asia-Pacific Sterility Testing market is projected to grow from 0.23 USD Billion in 2024 to 0.65 USD Billion by 2035.

Key Market Trends & Highlights

Asia Pacific Sterility Testing Market Key Trends and Highlights

- The market is expected to experience a compound annual growth rate of 9.94 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 0.65 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 0.23 USD Billion, reflecting the current demand for sterility testing solutions.

- Growing adoption of advanced testing technologies due to increasing regulatory requirements is a major market driver.

Market Size & Forecast

| 2024 Market Size | 0.23 (USD Billion) |

| 2035 Market Size | 0.65 (USD Billion) |

| CAGR (2025-2035) | 9.94% |

Major Players

Avance Biosciences (U.S.), Boston Scientific Corporation (U.S.), Paragon Bioservices, Inc (U.S.), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), Charles River Laboratories International, Inc. (U.S.), Avista Pharma Solutions (U.S.), DYNALABS LLC. (U.S.)