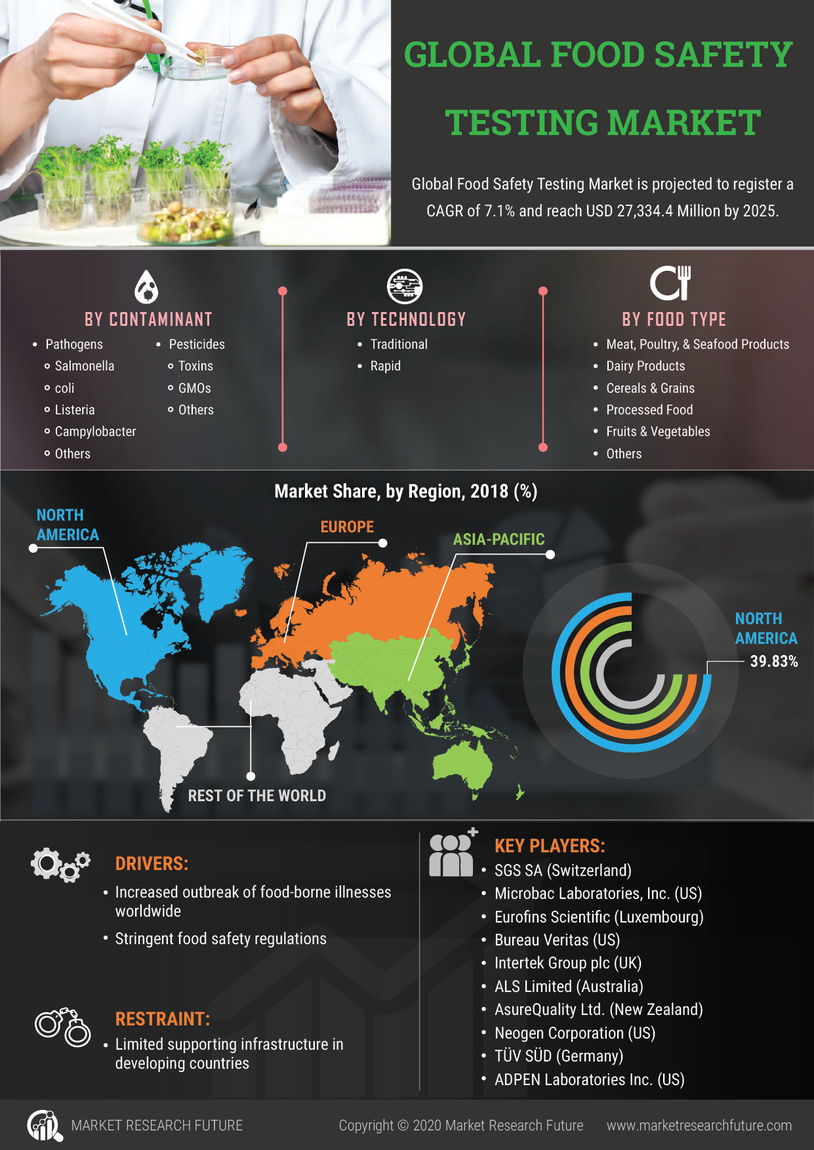

Global Food Safety Testing Market Summary

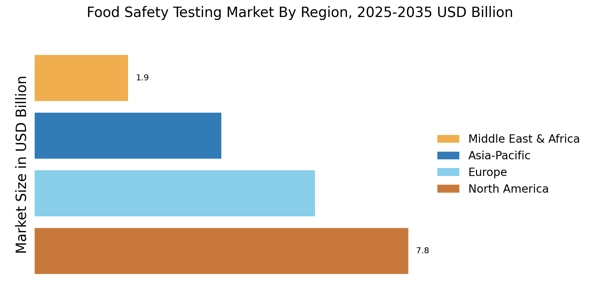

As per MRFR analysis, The Global Food Safety Testing Market was estimated at 19.37 USD Billion in 2024. The food safety testing industry is projected to grow from 20.75 USD Billion in 2025 to 41.2 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.1% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Global Food Safety Testing Market is poised for substantial growth driven by technological advancements and increasing regulatory demands.

- Technological advancements in testing methods are revolutionizing the efficiency and accuracy of food safety assessments.

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for food safety testing Market.

- Consumer demand for transparency in food sourcing is prompting companies to adopt more rigorous testing protocols.

- Rising incidences of foodborne illnesses and increased regulatory compliance are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 19.37 (USD Billion) |

| 2035 Market Size | 41.2 (USD Billion) |

| CAGR (2025 - 2035) | 7.1% |

Major Players

Eurofins Scientific (LU), SGS SA (CH), Intertek Group plc (GB), Bureau Veritas (FR), Neogen Corporation (US), Mérieux Nutrisciences (FR), TÜV SÜD AG (DE), ALS Limited (AU), Food Safety Net Services (US)