Rising Demand for Automation

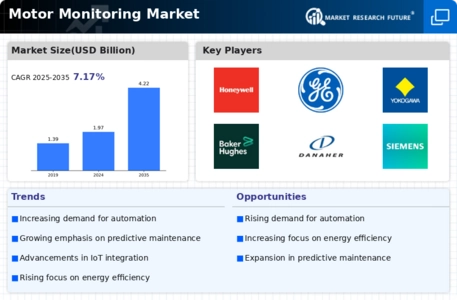

The increasing demand for automation across various industries is a primary driver for the Motor Monitoring Market. As organizations strive to enhance operational efficiency and reduce labor costs, the adoption of automated systems becomes essential. This trend is particularly evident in manufacturing, where automated machinery requires constant monitoring to ensure optimal performance. According to industry reports, the automation sector is projected to grow at a compound annual growth rate of over 10% in the coming years. Consequently, the need for effective motor monitoring solutions that can provide real-time data and analytics is likely to surge, thereby propelling the Motor Monitoring Market forward.

Growing Focus on Sustainability

The growing focus on sustainability and energy efficiency is increasingly shaping the Motor Monitoring Market. Organizations are under pressure to reduce their carbon footprint and optimize energy consumption. Motor monitoring systems play a crucial role in identifying inefficiencies and enabling organizations to implement energy-saving measures. The market for energy-efficient technologies is anticipated to expand significantly, with projections indicating a growth rate of around 9% per year. This trend not only aligns with global sustainability goals but also drives the adoption of motor monitoring solutions that can help organizations achieve their energy efficiency targets.

Advancements in Sensor Technology

Technological advancements in sensor technology are significantly influencing the Motor Monitoring Market. The development of sophisticated sensors that can monitor various parameters such as temperature, vibration, and current has enhanced the ability to detect anomalies in motor performance. These innovations allow for more accurate and timely data collection, which is crucial for predictive maintenance strategies. The market for sensors is expected to witness substantial growth, with estimates suggesting a rise of approximately 8% annually. This growth in sensor technology not only improves the reliability of motor monitoring systems but also expands their application across diverse sectors, thus driving the Motor Monitoring Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into motor monitoring systems is emerging as a transformative driver for the Motor Monitoring Market. AI technologies enable predictive analytics, allowing for more accurate forecasting of motor failures and maintenance needs. This capability enhances operational efficiency and reduces downtime, which is critical for industries reliant on continuous operations. The AI market in industrial applications is expected to grow at a remarkable pace, with estimates suggesting a compound annual growth rate of over 15%. As organizations increasingly adopt AI-driven solutions, the demand for advanced motor monitoring systems is likely to escalate, thereby propelling the Motor Monitoring Market.

Regulatory Compliance and Safety Standards

The increasing emphasis on regulatory compliance and safety standards is a significant driver for the Motor Monitoring Market. Industries are mandated to adhere to stringent safety regulations to minimize risks associated with equipment failure. This has led to a heightened focus on monitoring systems that can provide real-time insights into motor health and performance. As organizations seek to comply with these regulations, the demand for advanced motor monitoring solutions is expected to rise. Reports indicate that the market for safety compliance technologies is projected to grow by over 6% annually, further underscoring the importance of motor monitoring in maintaining compliance and ensuring workplace safety.