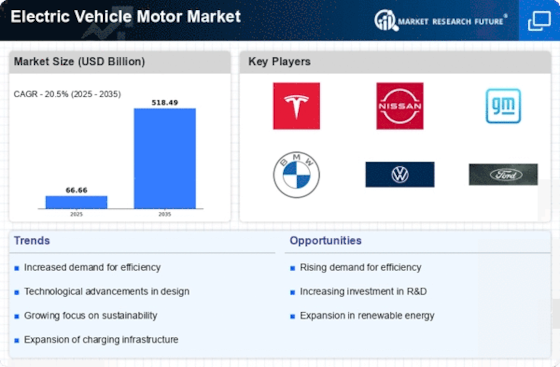

Major market players are spending a lot on R&D to increase their product lines, which will help to grow the electric vehicle motor market data. Market participants are also taking a range of strategic initiatives to grow their footprint ly, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, expand its investments, and collaboration with other organizations. Competitors in the electric vehicle motor industry must provide cost-effective items to expand and survive in an increasingly competitive and growing environment for electric vehicle motor market.

One of the primary business strategies manufacturers adopt in the electric vehicle motor industry to benefit clients and expand the market sector is manufacturing locally to reduce operating costs. In the electric vehicle motor market, major players such as Continental AG (Germany), Hitachi Automotive Systems Ltd. (Japan), Tesla Inc. (US) and others are working on expanding the electric vehicle motor market demand by investing in research and development activities and expanding the electric vehicle motor market revenue.

ABB Ltd is a technology leader in electrification and automation, allowing a more sustainable and resource-efficient future. The firm solutions connect engineering know-how and software to optimize how things are moved, manufactured, powered and operated. Building on more than 130 years of greatness, ABB's 105,000 employees are determined to drive innovations that fuel industrial transformation.

In August ABB announced that it had signed an acquisition to purchase Siemen's low-voltage NEMA motor business. With manufacturing operations in Guadalajara, Mexico, this acquisition provides a well-regarded product portfolio, a longstanding North American customer base, and experienced operations, sales, and management team.

Also, WEG is a electric-electronic equipment firm, operating majorly in the capital goods sector with solutions in electric machines, automation and paints for several sectors, including infrastructure, steel, pulp and paper, oil and gas, and mining, among many others. WEG stands out in innovation by constantly developing solutions to meet the major trends in energy efficiency, renewable energy and electric mobility. With manufacturing units in 12 countries and present in more than 135 countries, the company has more than 36,900 employees worldwide.

In July 2022, WEG launched the W12 electric vehicle motor, designed for high-performance industrial applications while offering versatility and efficiency.