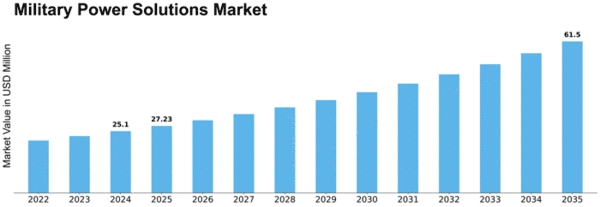

Military Power Solutions Size

Military Power Solutions Market Growth Projections and Opportunities

The military power solutions market is influenced by several key factors that shape its growth and development. One significant factor is the increasing demand for reliable, portable, and efficient power sources to support modern military operations. Military forces require power solutions to operate a wide range of equipment and systems, including communication devices, surveillance systems, unmanned vehicles, and electronic warfare systems, among others. As military operations become increasingly complex and technology-driven, there is a growing need for power solutions that can deliver sufficient energy to support mission-critical applications in diverse environments, from remote combat zones to forward operating bases.

Moreover, technological advancements play a crucial role in shaping the military power solutions market. Advances in battery technology, energy storage systems, renewable energy sources, and power management technologies have led to the development of more efficient, compact, and lightweight power solutions for military applications. Lithium-ion batteries, for example, offer higher energy density and longer operational lifetimes compared to traditional battery chemistries, making them well-suited for portable power applications in military environments. Additionally, advancements in renewable energy sources such as solar and wind power enable military forces to reduce reliance on fossil fuels and increase energy resilience in the field.

Furthermore, market demand for military power solutions is driven by factors such as operational requirements, environmental considerations, and budget constraints. Military forces require power solutions that are rugged, reliable, and capable of operating in harsh environmental conditions, including extreme temperatures, high humidity, and rough terrain. Additionally, as governments and defense agencies seek to reduce their carbon footprint and comply with environmental regulations, there is a growing interest in deploying eco-friendly power solutions that minimize emissions and environmental impact. Furthermore, budget constraints and cost considerations influence procurement decisions, driving demand for cost-effective power solutions that offer the best value for money in terms of performance, reliability, and lifecycle costs.

Moreover, the increasing adoption of electrification and digitization in military platforms and systems is driving market growth in the military power solutions sector. Modern military platforms, such as armored vehicles, aircraft, and naval vessels, are equipped with an array of electronic systems and sensors that require reliable and uninterrupted power to function effectively. Additionally, the proliferation of unmanned systems, including drones, robotics, and autonomous vehicles, further increases the demand for lightweight and portable power solutions that can power these systems during extended missions. Furthermore, the integration of advanced electronics, such as sensors, communication systems, and electronic warfare equipment, into military platforms drives demand for power solutions that can meet the increased power demands and ensure mission success.

Additionally, market factors such as geopolitical tensions, security threats, and modernization initiatives drive investment in military power solutions. As geopolitical tensions rise and security threats evolve, countries around the world are investing in strengthening their defense capabilities and modernizing their armed forces. This includes upgrading existing military platforms, acquiring new technologies, and enhancing operational readiness to address emerging threats and maintain strategic superiority. Military power solutions play a critical role in supporting these modernization efforts by providing the energy infrastructure needed to power advanced weapons systems, communication networks, and electronic warfare capabilities.

Furthermore, regulatory frameworks and standards significantly influence market dynamics in the military power solutions sector. Military power solutions must comply with stringent regulatory requirements and safety standards to ensure interoperability, reliability, and performance in military operations. Additionally, defense contractors and suppliers must adhere to export control regulations and international arms control agreements when supplying military power solutions to foreign customers. Compliance with these regulations is essential for maintaining market access, securing contracts, and building trust with military customers and stakeholders.

Moreover, market factors such as technological innovation, industry partnerships, and global collaborations drive market competitiveness and innovation in the military power solutions sector. Defense contractors, technology providers, and research organizations collaborate to develop and deploy cutting-edge power solutions that meet the evolving needs of military customers. Additionally, strategic partnerships and alliances enable companies to leverage complementary capabilities, resources, and expertise to develop integrated power solutions that offer enhanced performance, reliability, and efficiency. Furthermore, investment in research and development (R&D) and technology innovation drives market differentiation and fosters the development of next-generation power solutions that address emerging challenges and opportunities in military operations.

Leave a Comment