Technological Advancements in APU Design

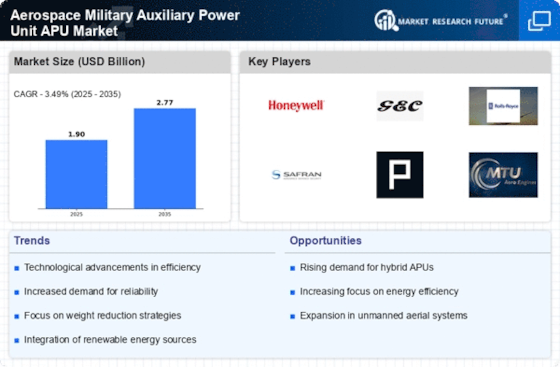

The aerospace military auxiliary power unit apu Market is experiencing a surge in technological advancements that enhance the efficiency and performance of APUs. Innovations such as improved fuel efficiency, reduced emissions, and advanced materials are being integrated into APU designs. For instance, the introduction of lightweight composite materials has led to a reduction in overall weight, which is crucial for military aircraft. Furthermore, the development of digital control systems allows for better monitoring and management of power output, thereby optimizing performance. These advancements not only improve operational capabilities but also align with the increasing demand for more sustainable military operations. As a result, the Aerospace Military Auxiliary Power Unit APU Market is likely to witness a significant transformation driven by these technological innovations.

Emerging Markets and Strategic Partnerships

Emerging markets are playing a pivotal role in shaping the Aerospace Military Auxiliary Power Unit APU Market. Countries with developing defense sectors are increasingly seeking to enhance their military capabilities, leading to a rise in demand for APUs. Strategic partnerships between established manufacturers and local firms are becoming common, facilitating technology transfer and localization of production. This trend not only supports the growth of the Aerospace Military Auxiliary Power Unit APU Market but also fosters innovation through collaboration. As these emerging markets continue to invest in their defense infrastructure, the Aerospace Military Auxiliary Power Unit APU Market is likely to experience robust growth driven by these strategic alliances.

Sustainability Initiatives in Military Operations

Sustainability initiatives are becoming increasingly relevant within the Aerospace Military Auxiliary Power Unit APU Market. Military organizations are under pressure to reduce their carbon footprint and enhance energy efficiency. This has led to a growing interest in APUs that utilize alternative fuels and hybrid technologies. The integration of sustainable practices not only meets regulatory requirements but also appeals to public sentiment regarding environmental responsibility. As military forces seek to modernize their fleets, the demand for eco-friendly APUs is expected to rise. This shift towards sustainability may drive innovation and investment in the Aerospace Military Auxiliary Power Unit APU Market, potentially leading to the development of next-generation systems that prioritize environmental considerations.

Growing Demand for Unmanned Aerial Vehicles (UAVs)

The Aerospace Military Auxiliary Power Unit APU Market is witnessing a growing demand for unmanned aerial vehicles (UAVs), which require reliable power sources for their operations. As military applications for UAVs expand, the need for efficient and lightweight APUs becomes increasingly critical. These power units are essential for supporting various UAV functions, including avionics, communication systems, and payload operations. The rise in UAV deployments for reconnaissance, surveillance, and combat missions is likely to drive the demand for specialized APUs tailored to meet the unique requirements of these platforms. Consequently, the Aerospace Military Auxiliary Power Unit APU Market is expected to evolve in response to this burgeoning segment.

Increased Defense Budgets and Military Modernization

The Aerospace Military Auxiliary Power Unit APU Market is poised for growth due to increased defense budgets across various nations. Governments are prioritizing military modernization to enhance operational readiness and capabilities. This trend is reflected in the rising investments in advanced technologies, including APUs, which are essential for powering onboard systems and ensuring mission success. For example, countries are allocating substantial funds to upgrade their fleets with state-of-the-art APUs that offer improved reliability and efficiency. As defense budgets continue to expand, the Aerospace Military Auxiliary Power Unit APU Market is likely to benefit from heightened demand for innovative and robust APU solutions.