Research Methodology on Military Satellite Market

Introduction

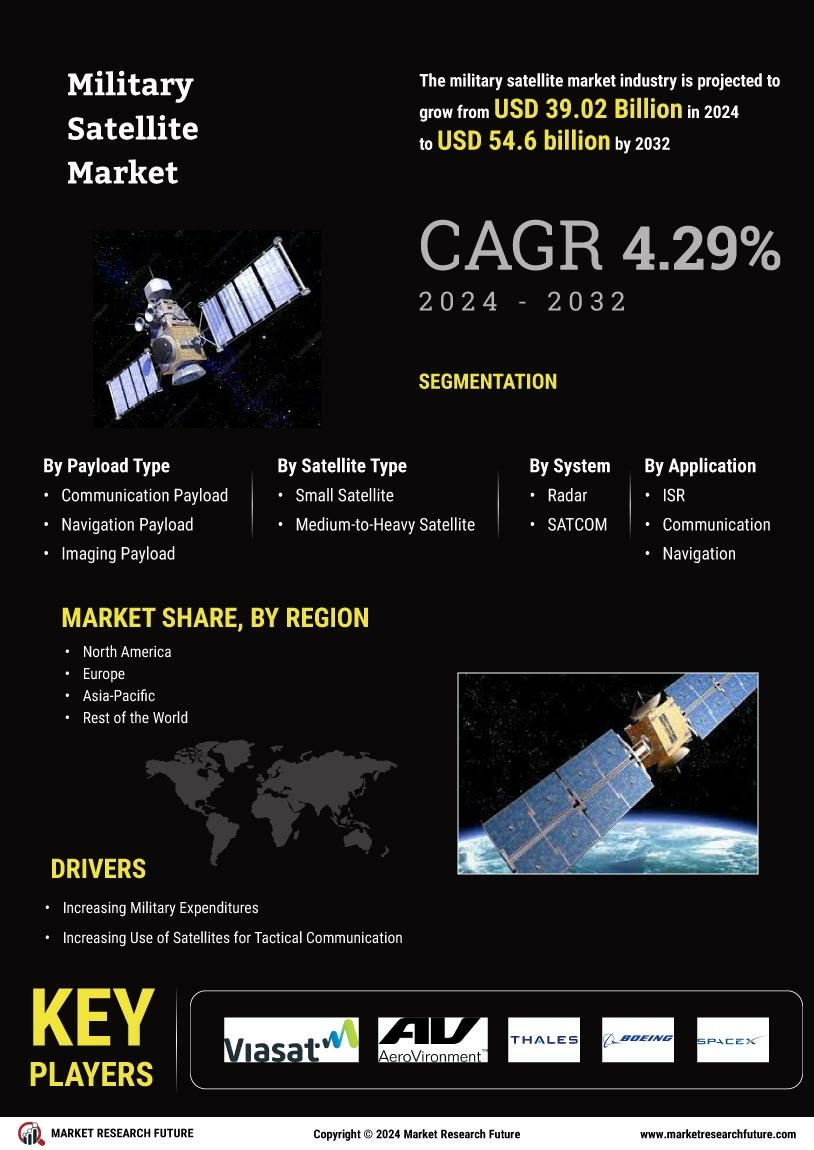

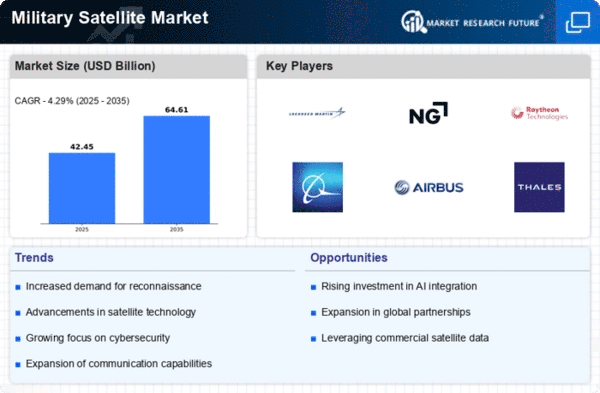

The global military satellite market is projected to register a steady CAGR during the forecast period (2023-2030). The global military satellite market is expected to witness significant growth attracted by factors such as the increasing focus of various governments in providing integrated solutions for defence and security, rising demand for real-time data from diverse geographic locations, and the increasing demand for communication and surveillance satellites. The market in the Americas is likely to dominate the military satellite market in terms of revenue, owing to the significant investments made by the Defence Advanced Research Projects Agency (DARPA) and the US Air Force.

Research Methodology

This research aims to provide a detailed analysis of the military satellite market and forecast its development in the coming years. This research is based on a unique methodology that includes both qualitative and quantitative analysis of the current and expected industry trends.

The first step of this research study includes collecting data from primary and secondary sources such as industry journals, market reports, trade journals, and other related information sources. market data from open sources such as trade journals, industry surveys and workshops, press releases and company websites were used as the primary source. Secondary sources included press releases and company product brochures.

The data collected is then analyzed and consolidated for inclusion in the study. Quantitative data is collected from industry surveys and usage statistics, while qualitative data is gathered from interviews, industry experts and market surveys. The results from these surveys and interviews are then validated to form an accurate representation of the market trends.

The analysis of the primary and secondary data collected includes the current and expected market size (in terms of revenue and volume) of the global military satellite market, the growth rate trends, the regional market breakdowns, competitor analysis, the emerging application areas, the technological advancements, product features and the research and development activities of leading players in the industry.

Furthermore, the market attractiveness assessment of each segment is conducted based on the current market dynamics. All these data points have been consolidated to form a comprehensive market analysis. To supplement this study further, a SWOT analysis has been conducted.

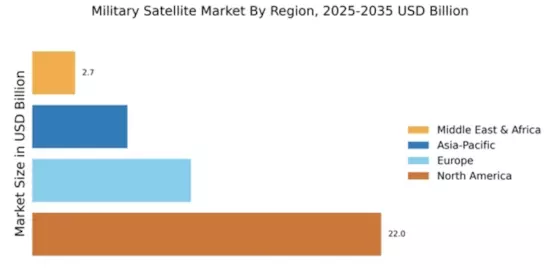

For the analysis of the global military satellite market, detailed market segmentation has been developed. The global market is divided into four regions, namely, North America, Europe, Asia-Pacific and Rest of the World (RoW). According to this segmentation, several sub-segments have been identified based on the various application areas, technologies, and products.

The data points collected were then used to calculate the market size (in terms of value and volume) of the global military satellite market. The market size has been calculated based on the number of end-users in each industry. Furthermore, consideration was also given to the geographic spread and application areas of the market.

The segmental data was then re-validated using the triangulation method with the help of industry experts. The market sizing and segmentation data were further used to calculate the CAGR and the expected growth of the military satellite market during the forecast period 2023 to 2030.

The gathered data was further used to calculate the share of each segment in the global military satellite market. The market share analysis was conducted based on the total number of end-users and their geographical spread. Furthermore, the competitive landscape was evaluated by studying the strategies being adopted by the key players, their market presence and technological offerings.

Finally, this study assesses the macroeconomic factors that are likely to have an impact on the global military satellite market. The factors analyzed include interest rates, inflation, corruption, and economic reforms. The global military satellite market is assessed based on the trends in the overall military satellite landscape and the expected change in the economic landscape and its impacts during the forecast period.

Conclusion

This research has provided an in-depth analysis and an estimated size of the military satellite market. The increasing demand for real-time data from far-flung areas, the ambitions of global governments to provide an array of integrated solutions for defence and security, and the demand for communication and surveillance satellites are some of the factors driving the global military satellite market. The report also provides an analysis of the competitive landscape of the industry and the key strategies being adopted by the leading players.