Rising Geopolitical Tensions

Rising geopolitical tensions globally are influencing the US military electro optical infrared systems market. As the security landscape becomes increasingly complex, the demand for advanced surveillance and reconnaissance capabilities is intensifying. The US military is prioritizing investments in electro-optical and infrared systems to address potential threats from adversaries. This strategic focus is evident in the allocation of resources towards enhancing ISR capabilities, which are critical for maintaining national security. The market is likely to see sustained growth as the military adapts to evolving threats and seeks to bolster its operational readiness.

Collaboration with Defense Contractors

Collaboration with defense contractors is a key driver in the US military electro optical infrared systems market. The military's partnerships with leading technology firms facilitate the development of cutting-edge systems that meet specific operational requirements. These collaborations often result in innovative solutions that enhance the effectiveness of electro-optical and infrared systems. The Department of Defense has established various programs to foster such partnerships, ensuring that the military benefits from the latest advancements in technology. As these collaborations continue to thrive, the market is expected to expand, driven by the introduction of new and improved systems.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the US military electro optical infrared systems market is transforming operational capabilities. AI enhances data processing and analysis, allowing for quicker decision-making in critical situations. The Department of Defense has recognized the potential of AI, investing heavily in research and development initiatives aimed at incorporating AI into existing systems. This integration is expected to improve target recognition and tracking, thereby increasing the effectiveness of military operations. As AI technologies continue to advance, their application within electro-optical and infrared systems is likely to expand, further driving market growth.

Increased Focus on Modernization Programs

The US military electro optical infrared systems market is witnessing a significant push towards modernization programs. The Department of Defense has outlined strategic initiatives aimed at upgrading existing systems to meet contemporary operational demands. This modernization effort includes the replacement of outdated equipment with state-of-the-art electro-optical and infrared systems. The fiscal year 2026 budget proposal indicates a substantial increase in funding for modernization projects, reflecting the military's commitment to enhancing its technological capabilities. As these programs progress, the market is expected to benefit from increased procurement and deployment of advanced systems.

Growing Demand for Surveillance Capabilities

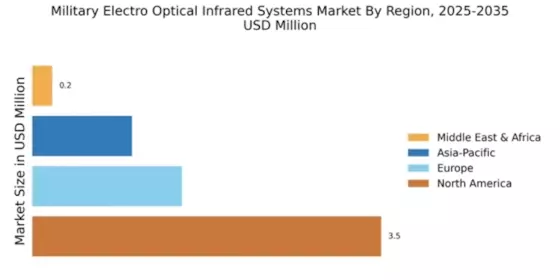

The US military electro optical infrared systems market is experiencing a notable increase in demand for advanced surveillance capabilities. This trend is driven by the need for enhanced situational awareness in various operational environments. The US Department of Defense has allocated substantial budgets for the procurement of electro-optical and infrared systems, with a projected growth rate of approximately 5% annually over the next five years. This growth is indicative of the military's commitment to maintaining a technological edge in intelligence, surveillance, and reconnaissance (ISR) operations. As threats evolve, the integration of sophisticated imaging technologies becomes paramount, thereby propelling the market forward.