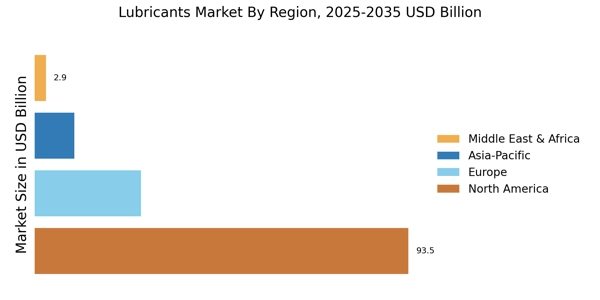

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific region is one of the largest lubricant markets in the world, with China and India being the key countries driving the growth. The growth of the automotive industry in the region, particularly in China and India, has been one of the major factors driving the demand for lubricants. With increasing demand for passenger cars and commercial vehicles in these countries, the demand for engine oils, transmission fluids, and other lubricants is also increasing.

In addition to the automotive industry, the growth of other end-use industries such as manufacturing, power generation, and construction is also driving the demand for lubricants in the region. These industries require a wide range of lubricants for various applications, such as hydraulic oils, gear oils, and compressor oils, among others.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil

Europe’s Lubricants Market accounts for the third-largest market share. Europe's lubricants market is a well-established market that is driven by various end-use industries such as automotive, industrial machinery, and marine, among others. The region is home to several major automotive manufacturers, which creates significant demand for lubricants in the region. The industrial machinery sector is also a significant end-user of lubricants in the region, driven by the demand for lubricants for a wide range of applications, including hydraulic oils, gear oils, and compressor oils.

Further, the Germany Lubricants Market held the largest market share, and the UK Lubricants Market was the fastest-growing market in the European region.

The North American lubricants market is a mature market and is characterized by a high degree of competition. The market is driven by various end-use industries such as automotive, industrial machinery, and marine, among others. The marine industry is important end-user of lubricants in the region, driven by the demand for marine engine oils and other lubricants for various applications. The growth of the shale gas industry in the region has also created opportunities for the lubricants market, particularly in the area of drilling fluids and other specialty lubricants.

Overall, the North American lubricants market is expected to grow at a steady rate in the coming years, driven by the growth of end-use industries and the increasing demand for high-performance lubricants. Moreover, the U.S. Lubricants Market held the largest market share, and the Canada Lubricants Market was the fastest-growing market in the North American region.