Research Methodology on Bio Lubricants Market

1. Introduction

This research study aims to provide an analysis of the global Bio-Lubricants Market. This comprehensive report provides a comprehensive overview and detailed insights into the global Bio-Lubricants Market. Moreover, the report also incorporates future prospects and potential of the market. The study provides an in-depth analysis of the global Bio-Lubricants Market covering the market trends over the forecast period 2023 to 2030.

The research methodology followed for this report is a mix of primary and secondary research. Further, a detailed analysis of the industry trends and current market state has been incorporated in this report. This report gives an in-depth view of the market, the opportunities it holds, and the challenges it faces.

2. Data Sources & Research Methodology

Various primary sources have been used in this research to obtain quantitative as well as qualitative information on the global Bio-Lubricants Market. The primary sources include interviews with stakeholders, government bodies, regulatory authorities, and associations for reliable and in-depth data collection and verification. Moreover, the secondary sources used for this research include market research reports, technical literature, and other paid databases.

Further, Validated by Essential Commodity Statistics from the Ministry of Petroleum, Ministry of Chemicals and Fertilizers, Government of India, and reports published by industry associations such as the World Lubricant Industry Association (WLIA) and Automotive Lubricants Manufacturers Association (ALMA) have also been referred by the team of analysts in order to get necessary insights.

The data obtained from the sources have been used to do the validation of the market value based on the primary research findings. The global Bio-Lubricants Market demand is estimated by using the bottom-up and top-down approaches. Moreover, the research study incorporates analysis of the data collected from various key players of the market using financials, including earnings and product portfolio.

3. Market Size Estimation

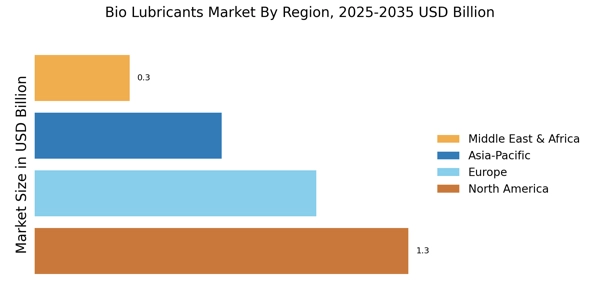

The global Bio-Lubricants Market sizing has been carried out using several approaches such as market analysis based on the demand and supply, for estimating the market size.

4. Market Breakdown & Data Triangulation

The team then tested and validated these figures by triangulating the same with the help of various industry experts and sources. Further, the global Bio-Lubricants Market has been segmented according to region, applications and product.

5. Market Forecasting

In order to forecast the market size of the global Bio-Lubricants Market, various forecasting models have been used. The forecasting models used are CAGR (Compound Annual Growth Rate), Regression, and Correlation Analysis.