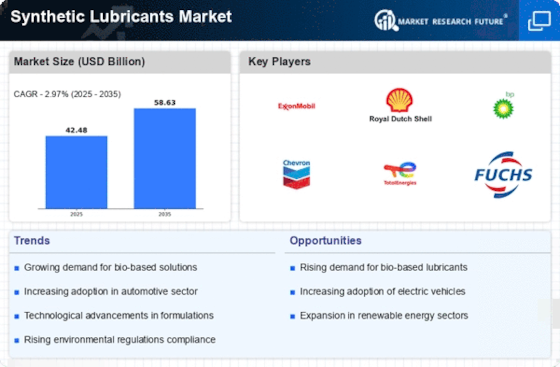

Major market players are spending a lot of money on R&D to increase their product lines, which will help the synthetic lubricants market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the synthetic lubricants industry must offer cost-effective products to expand and survive in an increasingly competitive and rising market environment.

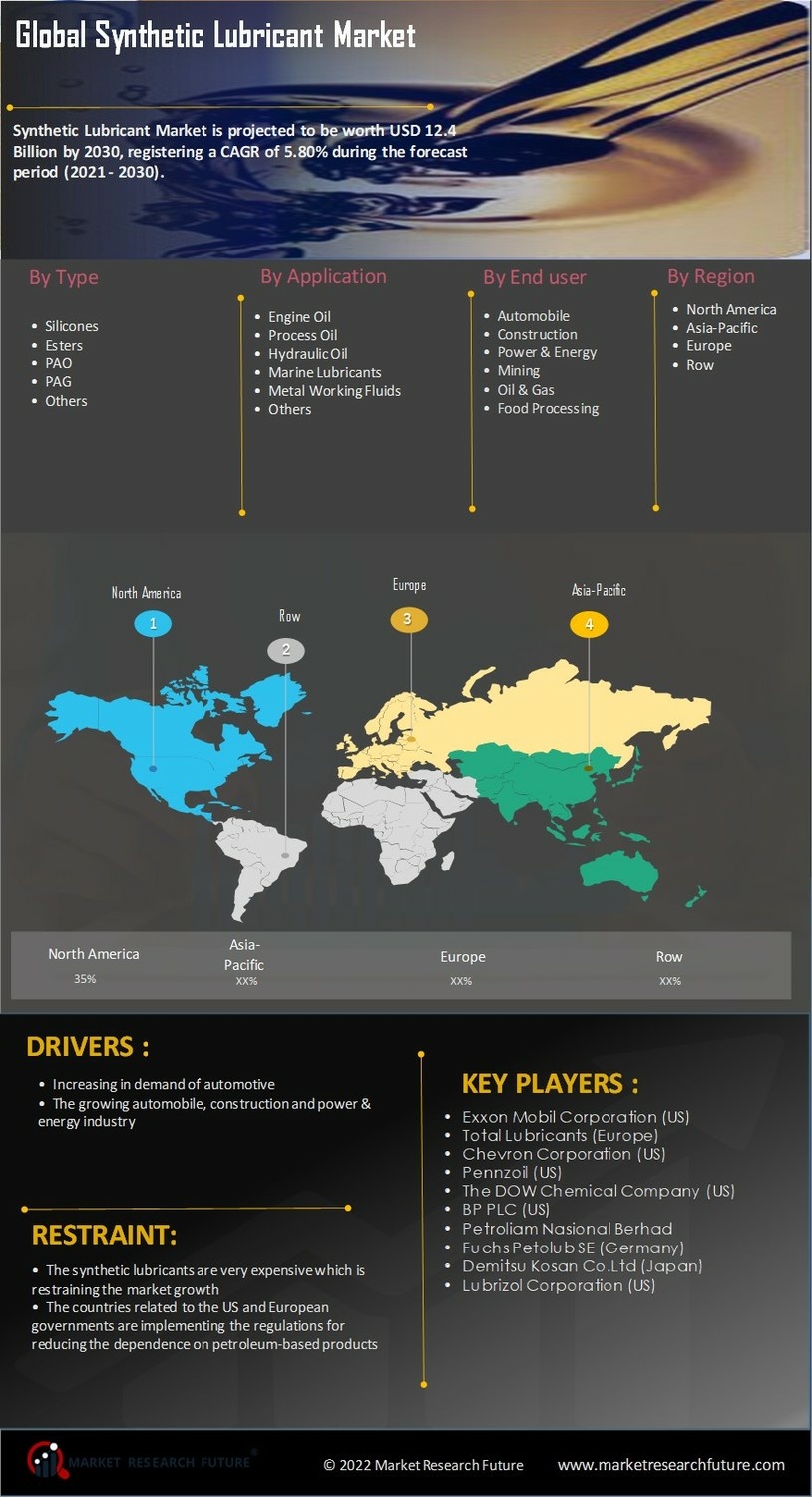

One of the primary business strategies adopted by manufacturers in the synthetic lubricants industry to benefit customers and expand the market sector is to manufacture locally to reduce operating costs. In recent years, the synthetic lubricants industry has provided lubricants with some of the most significant benefits. The synthetic lubricants market major players such as Chevron Corporation, ExxonMobil Corporation, Total Lubricants, and others are working to expand the market demand by investing in research and development activities.

American multinational oil and gas company Chevron Corporation specializes mostly in oil and gas. Its headquarters are in San Ramon, California, and it operates in more than 175 countries. It is the second-largest direct descendant of Standard Oil and was once known as the Standard Oil Company of California. The company’s Chevron, Texaco, and Caltex brands are well known for their high standards of performance, quality, and technology. Their lubricating products are commonly used in automobiles, trucks, buses, and industrial machinery.

In Jan 2023, Chevron announced intentions to increase its share buyback budget by three times, to a stunning USD 75 billion, making it the largest shareholder payout in the history of the oil industry. The decision was made as the company prepares to announce 2022 profits that have increased by a factor of two to USD 37.2 billion.

Also, The Irving, Texas-based ExxonMobil Corporation is a multinational American oil and gas company. ExxonMobil develops and deploys next-generation technologies to enable safely and ethically meet the world's growing demand for energy and high-quality chemical products. ExxonMobil is one of the leading public companies’ energy providers and chemical manufacturers in the world.

In March Mobil Serv SM Lubrication Management, a low-cost automated maintenance management system that enables operators to effectively coordinate, automate, and accelerate maintenance-related processes, has been launched by ExxonMobil.

Bharat Petroleum Corporation Ltd (BPCL), which controls around 12 percent of the lubes market through Mak-branded lubricants, will introduce two high-quality synthetic lubes for premium cars and bikes next week. Mak’s main brand sells about 3.3 lakh tonnes of lubes yearly, valued at around Rs 3,000 crore. The company said it would launch Mak TitaniumCK4, which is an ultra-low emission diesel engine lube for BS-VI cars, and Mak BlazeSynth for high-end bikes; both are fully synthetic oils.

Steelbird International, a Delhi-based automotive system maker, has launched its own motorcycle engine oil, including lubricants, into a new market segment in July 2021. Helmets manufacturer Steelbird International has entered into a new line of business with its latest venture into the lubricant market space targeting two-wheelers. The Steelbird’s lubricating agent line counts on starting from 4T engine oil SAE 20W40 API SL (900 ml), having a price as low as Rs.366 per unit. The lubricant sold in the quantity of one liter is Steelbird 4T engine oil SAE 20W40 API SL, which costs Rs. 394.

The third oil listed under lubricants is Steelbird 4T engine oil SAE 15W50 API Semi-Synthetic (2.5L); its price is Rs.1075.