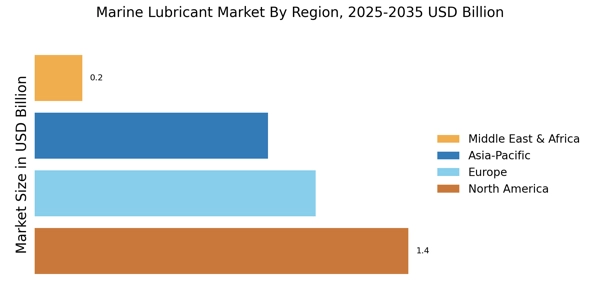

North America : Leading Marine Lubricant Market

North American Marine Lubricant Market is the largest market holding approximately 40% of the global share. The growth is driven by increasing maritime trade, stringent environmental regulations, and advancements in lubricant technology. The U.S. and Canada are the primary contributors, with a rising demand for eco-friendly lubricants and compliance with regulations such as the EPA's Vessel General Permit, which mandates the use of environmentally acceptable lubricants.

The competitive landscape is dominated by key players like ExxonMobil, Chevron, and Shell, who are investing in R&D to develop high-performance lubricants. The presence of major shipping routes and ports in the U.S. further enhances market dynamics. Additionally, the focus on sustainability and reducing emissions is pushing companies to innovate, ensuring a robust market environment for marine lubricants in the region.

Europe : Innovative Solutions in Europe

Europe is the second-largest market for marine lubricants, accounting for around 30% of the global market share. The region's growth is fueled by stringent environmental regulations, such as the EU's Marine Strategy Framework Directive, which promotes the use of sustainable and biodegradable lubricants. Countries like Germany, the UK, and Norway are leading the charge, with increasing investments in green technologies and a shift towards low-emission vessels. The competitive landscape features major players like TotalEnergies, BP, and Fuchs Petrolub, who are focusing on innovation and sustainability. The presence of advanced maritime infrastructure and a strong regulatory framework supports the growth of the marine lubricant market. Additionally, collaborations between manufacturers and shipping companies are enhancing product development, ensuring compliance with evolving regulations and market demands.

Asia-Pacific : Emerging Market Potential

Based on Marine Lubricants Market share, Asia-Pacific is rising as the emerging market, holding approximately 25% of the global market. The region's expansion is driven by increasing shipping activities, economic growth, and rising investments in maritime infrastructure. Countries like China, Japan, and South Korea are at the forefront, with a growing demand for high-performance lubricants to meet the needs of modern vessels and comply with international regulations.

The competitive landscape is characterized by both global and local players, including Jotun and Lukoil, who are adapting to regional demands. The focus on enhancing operational efficiency and reducing environmental impact is pushing companies to innovate. Additionally, government initiatives aimed at improving maritime safety and sustainability are further propelling the market, making Asia-Pacific a key player in the global marine lubricant industry.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is emerging as a significant player in the marine lubricant market, accounting for about 5% of the global share. The growth is driven by the region's strategic location for shipping routes and increasing oil and gas activities. Countries like the UAE and South Africa are investing in maritime infrastructure, which is expected to boost demand for marine lubricants in the coming years. The competitive landscape includes both international and regional players, with companies focusing on developing products tailored to local needs. The presence of key players like Castrol and Kluber Lubrication enhances market dynamics. Additionally, the region's focus on diversifying its economy and enhancing maritime capabilities is likely to create new opportunities for growth in the marine lubricant sector.