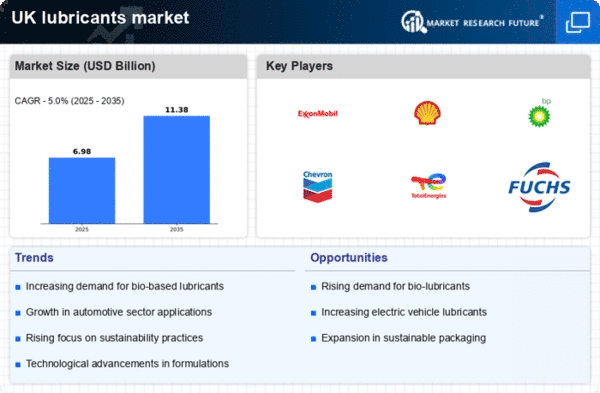

The lubricants market exhibits a dynamic competitive landscape characterized by a blend of innovation, sustainability, and strategic partnerships. Key players such as ExxonMobil (US), Shell (GB), and BP (GB) are at the forefront, leveraging their extensive resources to enhance product offerings and expand market reach. ExxonMobil (US) focuses on technological advancements in synthetic lubricants, while Shell (GB) emphasizes sustainability through its commitment to reducing carbon emissions in its production processes. BP (GB) is actively pursuing digital transformation initiatives to optimize supply chain efficiency, thereby enhancing customer engagement and operational effectiveness. Collectively, these strategies not only bolster their competitive positioning but also shape the overall market dynamics, fostering a climate of innovation and responsiveness to consumer demands.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain resilience. This approach appears to be particularly effective in a moderately fragmented market where regional players also exert influence. The competitive structure is characterized by a mix of large multinationals and smaller niche players, each contributing to a diverse product landscape. The collective influence of these key players is significant, as they drive trends in product development and sustainability initiatives, thereby shaping consumer preferences and market expectations.

In October Shell (GB) announced a strategic partnership with a leading renewable energy firm to develop bio-lubricants aimed at reducing environmental impact. This collaboration is poised to enhance Shell's product portfolio, aligning with the growing consumer demand for sustainable solutions. The strategic importance of this move lies in its potential to position Shell as a leader in the eco-friendly lubricants segment, thereby attracting environmentally conscious consumers and businesses alike.

In September BP (GB) launched a new line of high-performance lubricants designed specifically for electric vehicles (EVs). This initiative reflects BP's recognition of the shifting automotive landscape and the increasing prevalence of EVs. By catering to this emerging market, BP not only diversifies its product offerings but also reinforces its commitment to innovation in response to evolving consumer needs. This strategic action is likely to enhance BP's competitive edge in a rapidly changing market.

In November ExxonMobil (US) unveiled a new digital platform aimed at streamlining lubricant supply chain management for its customers. This platform integrates advanced analytics and AI to optimize inventory levels and reduce operational costs. The strategic significance of this development lies in its potential to enhance customer satisfaction through improved service delivery and responsiveness, thereby solidifying ExxonMobil's position as a technology leader in the lubricants market.

As of November the competitive trends in the lubricants market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies seek to leverage complementary strengths to enhance their market offerings. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends. Companies that prioritize sustainable practices and technological advancements are likely to emerge as leaders in this rapidly evolving landscape.