Industrial Lubricants Market Summary

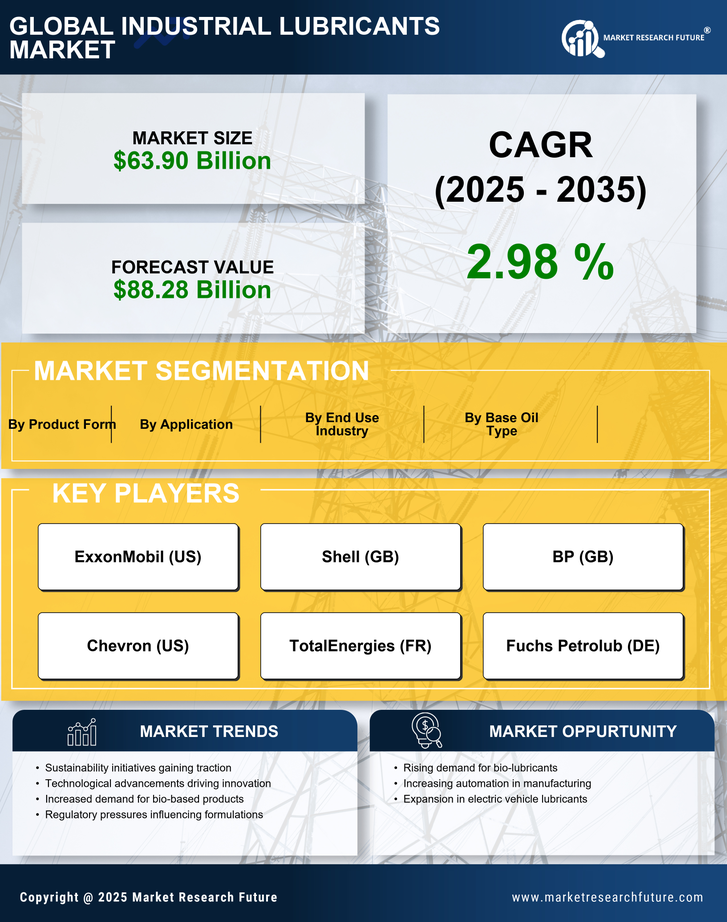

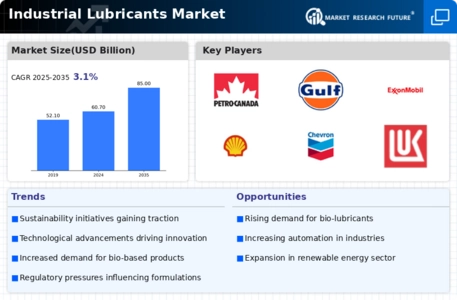

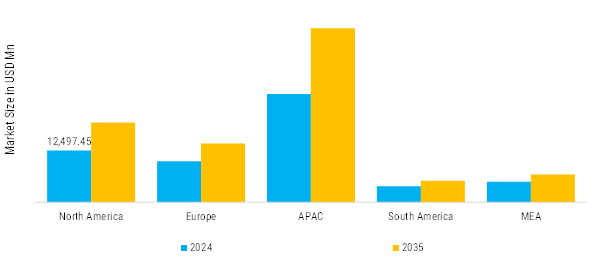

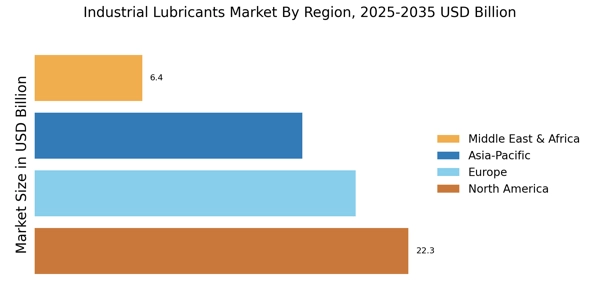

As per Market Research Future analysis, the Industrial Lubricants Market Size was estimated at 57,301.482 USD Million in 2024. The Global Industrial Lubricants industry is projected to grow from USD Million in 2025 to 87,270.543 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.89 % during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Industrial Lubricants Market is witnessing steady growth, driven by expanding industrialization, rising manufacturing output, and increasing demand from automotive, metalworking, power generation, mining, construction, and general manufacturing sectors.

- rowing emphasis on equipment efficiency, operational reliability, and preventive maintenance is accelerating the adoption of high-performance lubricants, including synthetic and semi-synthetic formulations, to reduce friction, wear, and unplanned downtime.

- Stringent environmental and occupational safety regulations are driving the shift toward low-toxicity, biodegradable, and environmentally acceptable lubricants (EALs), particularly in marine, forestry, and food processing applications.

- Demand for specialty and application-specific lubricants is rising, supported by advancements in machinery, higher operating temperatures, increased load conditions, and the need for extended oil drain intervals across industrial operations.

- Product innovation and formulation customization are intensifying, with manufacturers focusing on bio-based lubricants, high-viscosity-index fluids, multifunctional additives, and smart lubricants compatible with Industry 4.0 and condition-monitoring systems.

- Strategic mergers, acquisitions, and capacity expansions are strengthening the global footprint and technological capabilities of key players, while investments in R&D and localized production are improving supply chain resilience and customer responsiveness.

Market Size & Forecast

| 2024 Market Size | 57,301.482 (USD Million) |

| 2035 Market Size | 87,270.543 (USD Million) |

| CAGR (2025 - 2035) | 3.89% |

Major Players

China National Petroleum Corporation, Exxonmobil Corporation, BP PLC, Shell PLC,Totalenergies Se, Lubrizol Corporation, Fuchs, Idemitsu Kosan Co., LTD, Chevron Corporation, SKF Group