Growing Awareness and Education

The growing awareness and education surrounding hyperlipidemia and its associated risks are pivotal in shaping the Hyperlipidemia Drug Market. Public health campaigns and educational initiatives aimed at informing individuals about the dangers of high cholesterol levels have led to increased screening and diagnosis rates. As more people become aware of their lipid profiles, the demand for effective treatment options rises. This heightened awareness is further supported by healthcare professionals advocating for proactive management of cholesterol levels to prevent cardiovascular diseases. Consequently, the market for hyperlipidemia drugs is likely to expand as patients seek pharmacological solutions to manage their conditions. The emphasis on patient education and engagement is expected to play a significant role in driving the growth of the Hyperlipidemia Drug Market.

Advancements in Drug Development

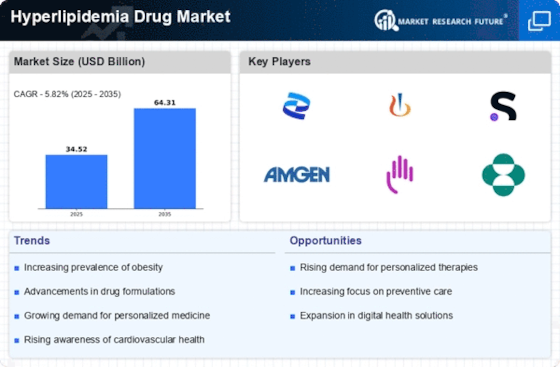

Innovations in drug development are significantly influencing the Hyperlipidemia Drug Market. The introduction of novel therapeutics, such as PCSK9 inhibitors and bempedoic acid, has expanded treatment options for patients with hyperlipidemia. These advancements not only enhance the efficacy of lipid management but also cater to patients who are intolerant to traditional therapies. The market for these innovative drugs is projected to witness robust growth, with some estimates suggesting a compound annual growth rate of over 10% in the coming years. Furthermore, ongoing research into combination therapies may provide additional avenues for treatment, thereby increasing the overall market potential. As pharmaceutical companies invest in research and development, the Hyperlipidemia Drug Market is likely to experience a surge in new product launches and improved patient outcomes.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes are essential drivers of the Hyperlipidemia Drug Market. Regulatory agencies are increasingly recognizing the need for effective treatments for hyperlipidemia, leading to expedited review processes for new drugs. This trend is particularly beneficial for innovative therapies that address unmet medical needs. For example, recent approvals of novel lipid-lowering agents have been facilitated by adaptive trial designs and real-world evidence, allowing for quicker access to patients. As regulatory bodies continue to prioritize the approval of effective treatments, the market for hyperlipidemia drugs is expected to flourish. This supportive regulatory environment not only encourages pharmaceutical companies to invest in research and development but also enhances patient access to essential medications, thereby driving growth in the Hyperlipidemia Drug Market.

Increasing Healthcare Expenditure

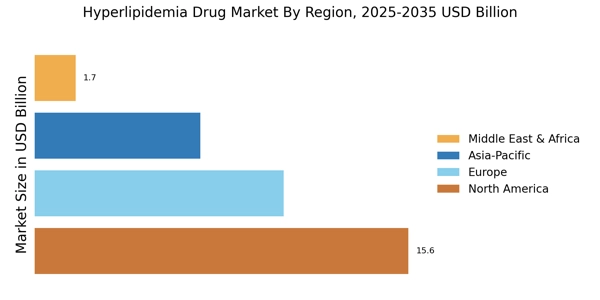

Rising healthcare expenditure is a crucial factor driving the Hyperlipidemia Drug Market. As countries allocate more resources to healthcare, there is a corresponding increase in spending on medications for chronic conditions, including hyperlipidemia. This trend is particularly evident in regions where healthcare reforms are underway, leading to improved access to medications. For instance, in certain markets, healthcare spending on cardiovascular drugs has seen a notable increase, reflecting a growing commitment to managing lipid disorders. Additionally, the shift towards value-based care models encourages healthcare providers to invest in effective treatments that can reduce long-term healthcare costs associated with cardiovascular diseases. Consequently, the Hyperlipidemia Drug Market stands to benefit from this upward trajectory in healthcare investment.

Rising Prevalence of Hyperlipidemia

The increasing prevalence of hyperlipidemia is a primary driver for the Hyperlipidemia Drug Market. As lifestyle-related factors such as poor diet, sedentary behavior, and obesity continue to rise, the number of individuals diagnosed with hyperlipidemia is expected to grow. According to recent estimates, nearly 40% of adults in certain regions exhibit elevated cholesterol levels, necessitating effective pharmacological interventions. This trend is likely to propel demand for various lipid-lowering agents, including statins and newer classes of medications. The growing awareness of cardiovascular risks associated with hyperlipidemia further emphasizes the need for treatment, thereby expanding the market for hyperlipidemia drugs. As healthcare providers increasingly prioritize lipid management, the Hyperlipidemia Drug Market is poised for substantial growth.