Rising Geriatric Population

The increasing geriatric population is a significant factor propelling the Erythropoietin Drugs Market. Older adults are more susceptible to chronic diseases, including CKD and anemia, which necessitates effective treatment options. As the global population ages, the demand for erythropoietin drugs is expected to rise correspondingly. Data indicates that by 2030, the number of individuals aged 60 and above will surpass 1.4 billion, creating a substantial market for anemia treatments. This demographic shift presents a unique opportunity for the Erythropoietin Drugs Market to expand its reach and cater to the specific needs of older patients.

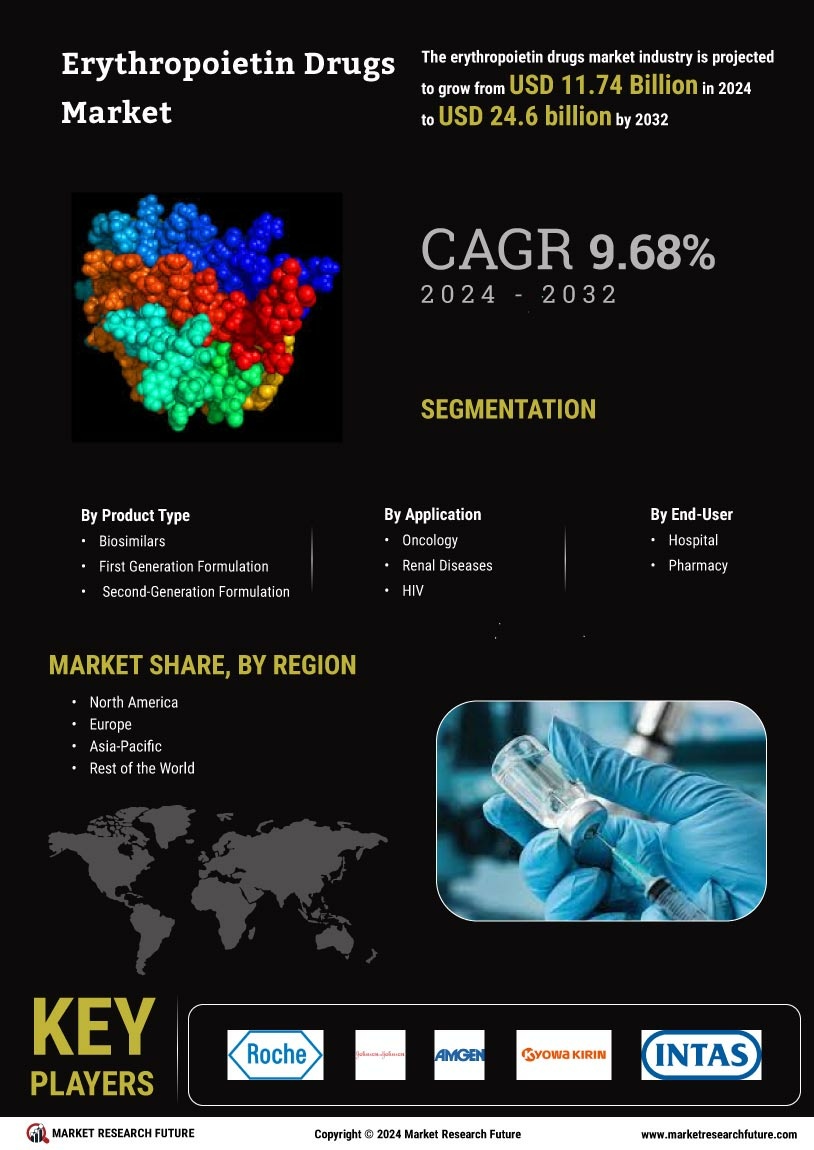

Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the Erythropoietin Drugs Market. Innovations in recombinant DNA technology have led to the development of more effective and safer erythropoietin formulations. These advancements not only enhance the efficacy of treatments but also reduce the risk of adverse effects, thereby increasing patient compliance. The market for erythropoietin drugs is projected to expand as new biotechnological products enter the market, offering improved therapeutic options. Furthermore, the integration of biotechnology in drug development is expected to streamline production processes, potentially lowering costs and increasing accessibility for patients in need.

Growing Awareness of Anemia Management

There is a notable increase in awareness regarding the management of anemia, particularly in patients with chronic illnesses. This growing awareness is driving the Erythropoietin Drugs Market as healthcare professionals and patients alike recognize the importance of effective anemia treatment. Educational initiatives and campaigns aimed at both patients and healthcare providers are contributing to this trend. As a result, more patients are being diagnosed and treated for anemia, leading to an uptick in erythropoietin drug Market prescriptions. The market is likely to benefit from this heightened focus on anemia management, as it aligns with broader healthcare goals of improving patient outcomes.

Increasing Prevalence of Chronic Kidney Disease

The rising incidence of chronic kidney disease (CKD) is a pivotal driver for the Erythropoietin Drugs Market. As CKD progresses, patients often develop anemia due to reduced erythropoietin production. This has led to a heightened demand for erythropoietin drugs, which are essential in managing anemia associated with CKD. According to recent data, approximately 10% of the population is affected by CKD, and this number is expected to rise. Consequently, the Erythropoietin Drugs Market is likely to experience substantial growth as healthcare providers increasingly prescribe these medications to improve patient outcomes and quality of life.

Regulatory Support for Erythropoietin Therapies

Regulatory bodies are increasingly supportive of erythropoietin therapies, which is likely to bolster the Erythropoietin Drugs Market. Streamlined approval processes and favorable guidelines for the use of erythropoietin drugs in various clinical settings are encouraging pharmaceutical companies to invest in research and development. This regulatory environment not only facilitates the introduction of new products but also enhances the market's overall growth potential. As more erythropoietin formulations receive approval, the market is expected to witness an influx of innovative therapies, ultimately benefiting patients and healthcare providers alike.