Research Methodology on High Density Interconnect PCB Market

This research study uses primary and secondary sources to comprehensively analyze the global High Density Interconnect PCB market. Primary sources include industry experts from core and related industries. Secondary sources include press releases, articles, government publications, trade associations, market research studies and surveys. The research data includes market size, revenue forecasts, regional estimates, competitive intelligence and growth opportunities.

Market Research Future (MRFR) has employed a thorough research methodology to furnish a detailed and profound analysis of the High-Density Interconnect PCB market that serves to guide stakeholders. The following points highlight the interpretation of the research data and the steps behind the arrival of the market size equations.

Research Approach

MRFR's research process involves in-depth secondary research, primary interviews and validation from industry experts. Secondary research sources include press releases, investor presentations, SEC filings, annual reports, various international websites, scholarly articles and databases. Primary research sources include in-depth interviews and surveys with industry experts, global vendors, company owners, and executives.

Data Collection

The research process beings with data collection both from secondary and primary sources. Besides this, MRFR also conducts independent research to garner exact market information. The facts and figures gathered from both sources are compared and validated to curate the data points.

Structure of the Study

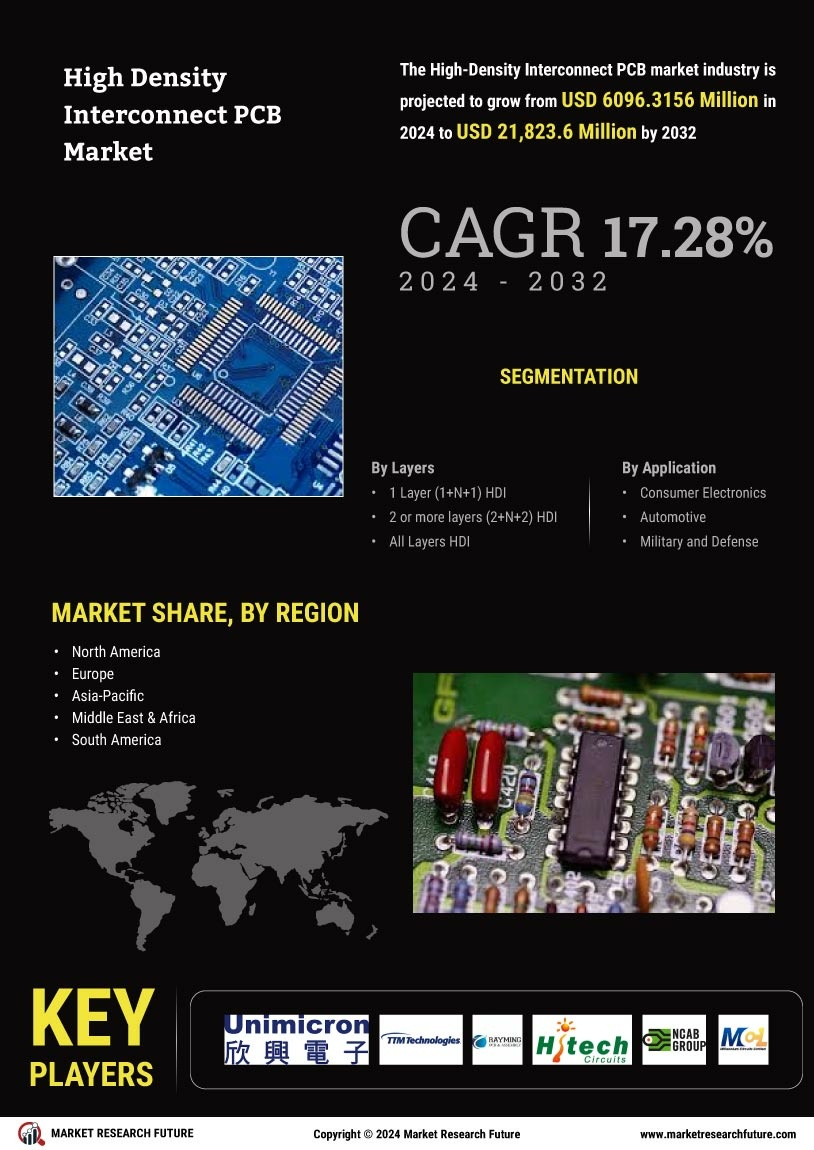

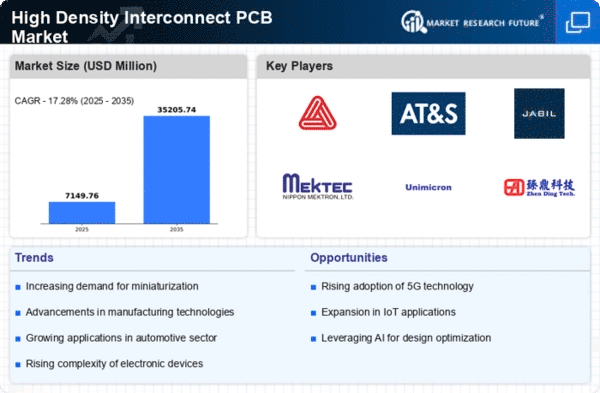

The High Density Interconnect PCB market report encompasses a comprehensive outline of the global market with brief analysis, industry insights and knowledgeable information related to the market. The report highlights the dynamic aspects of the market sector such as drivers, restraints, opportunities and challenges that influence the growth and growth potential of the sector. The report is also equipped with market size and forecast, which is estimated to offer a complete picture of the latest market scenarios.

Insights

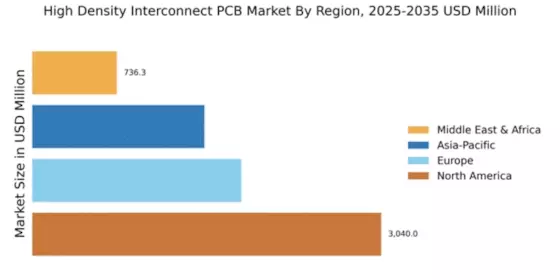

MRFR provides independent analyses of the global High Density Interconnect PCB market, emphasizing important aspects of the sector such as market trends and regional markets. The report also highlights important facets such as the SWOT analysis, key segments, and product portfolio covering a wide range of aspects. Furthermore, the market share of each company, financial analysis and key trends are analysed, offering a bird's eye view of the industry.

Analysis

The data collected from both primary and secondary sources is analysed to get a detailed understanding of the global High Density Interconnect PCB market. This analysis helps to understand the performance of the market with respect to different market scenarios.

Validation

The data points estimated and analyzed with different tools such as SPSS software, and Minitab, are compared and validated with the actual market scenarios. The estimated data is further improved with the help of industry comments to ensure the accuracy and reliability of the market figures.

Conclusion

The final step of the High Density Interconnect PCB market study involves summarizing the insights gathered from primary and secondary research and industry expert interviews. The report includes all the major elements such as market size, market growth, market trends, and challenges faced by the industry players which helps to formulate strategies for the market players to gain maximum profits within the predicted market timeline (2023 -2030).