High Density Interconnect Pcb Size

High Density Interconnect PCB Market Growth Projections and Opportunities

In the realm of electronics, high-density interconnect (HDI) printed circuit boards (PCBs) have emerged as a transformative technology, revolutionizing the design and manufacturing of electronic devices. HDI PCBs are characterized by their intricate microvias, blind vias, and via-in-pad (VIP) structures, enabling them to pack significantly more circuitry into a smaller space compared to traditional PCBs. This remarkable capability has propelled HDI PCBs to the forefront of modern electronics, catering to the ever-increasing demand for miniaturization and enhanced performance.

The genesis of HDI PCB technology can be traced back to the 1980s, when the pursuit of smaller and more powerful electronic devices fueled the need for more efficient packaging solutions. Conventional PCBs, with their larger vias and limited routing capabilities, were no longer sufficient to accommodate the demands of shrinking components and complex circuitry. HDI PCBs emerged as the answer, offering a quantum leap in circuit density and paving the way for a new era of electronic innovation.

At the heart of HDI PCB technology lies the concept of microvias, which are tiny vias measuring just a few micrometers in diameter. These microvias enable designers to connect different layers of the circuit board with much finer lines and tighter spacing, dramatically increasing the available circuit density. Blind vias, which are buried within the PCB layers, further enhance routing flexibility and contribute to the overall compactness of the circuit board.

The introduction of VIP technology in the early 2000s marked a significant milestone in HDI PCB development. VIP structures place vias directly within the solder pads of components, eliminating the need for separate via holes and further reducing the space occupied by circuitry. This innovation has been instrumental in enabling the realization of ultra-miniature electronic devices, such as smartphones and wearable electronics.

The advantages of HDI PCBs extend far beyond their remarkable size reduction capabilities. They offer a multitude of benefits that make them indispensable in today's demanding electronics landscape:

Enhanced Performance: HDI PCBs support higher signal speeds and frequencies, enabling faster data transmission and improved overall system performance. This is crucial for applications such as high-speed data communication, wireless networking, and advanced computing.

Reduced Power Consumption: The smaller components and shorter lines in HDI PCBs contribute to lower power consumption, making them an ideal choice for energy-efficient electronic devices.

Improved Reliability: HDI PCBs are less susceptible to noise and interference, leading to enhanced system reliability and reduced susceptibility to malfunctions.

Greater Flexibility: HDI PCBs can be designed in a wider range of shapes and sizes, providing greater flexibility for engineers and designers to create innovative form factors.

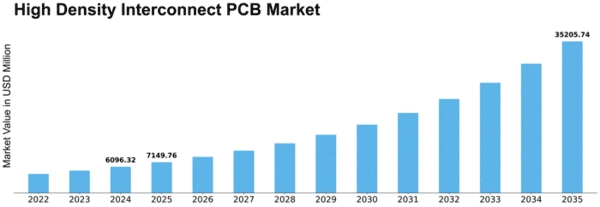

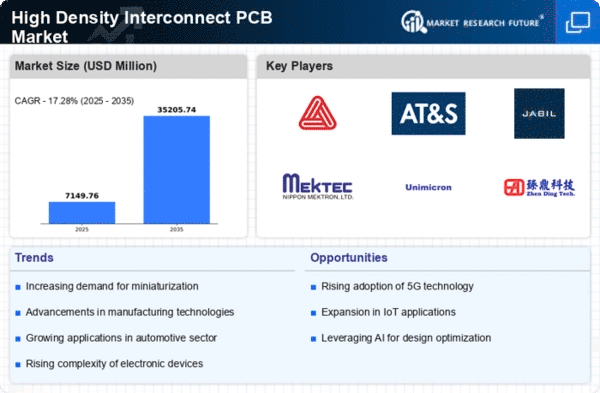

The demand for HDI PCB manufacturing is soaring driven by the relentless pursuit of miniaturization, performance enhancement, and energy efficiency in electronic devices. This growth is further fueled by the expansion of applications that demand high-density circuitry, such as smartphones, tablets, wearable electronics, and high-performance computing systems.

As the demand for HDI PCBs continues to rise, manufacturers are constantly innovating to develop new techniques and processes that further enhance the capabilities of these remarkable circuit boards. These advancements include the use of laser drilling for precise via formation, the development of advanced materials with superior electrical and thermal properties, and the implementation of sophisticated design tools that optimize circuit placement and routing.

The future of HDI PCB technology is bright, with continued advancements promising even smaller, faster, and more powerful circuit boards. As we move into the era of the Internet of Things (IoT) and artificial intelligence (AI), HDI PCBs will play a pivotal role in enabling the development of increasingly complex and interconnected devices that will shape the future of technology.

Leave a Comment