Rising Demand for Miniaturization

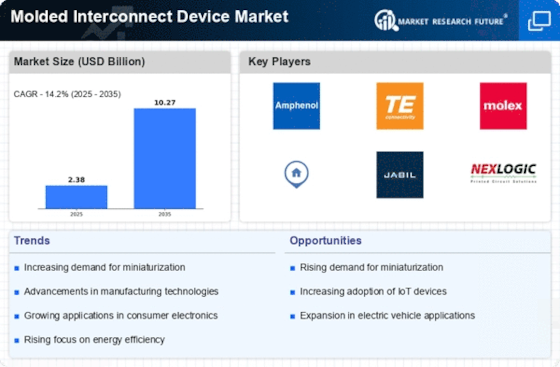

The Molded Interconnect Device Market is experiencing a notable surge in demand for miniaturization across various sectors, particularly in consumer electronics and automotive applications. As devices become smaller and more compact, the need for efficient interconnect solutions that occupy minimal space while maintaining performance is paramount. This trend is driven by consumer preferences for lightweight and portable devices, which has led manufacturers to seek innovative solutions. The market for molded interconnect devices is projected to grow at a compound annual growth rate of approximately 10% over the next five years, indicating a robust demand for these technologies. Consequently, companies are investing in research and development to create advanced molded interconnect devices that meet these evolving requirements.

Emergence of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Molded Interconnect Device Market. As smart technologies become more prevalent in homes, industries, and cities, the demand for efficient interconnect solutions is escalating. Molded interconnect devices are well-suited for IoT applications due to their compact design and ability to integrate multiple functionalities. This trend is expected to drive substantial growth in the market, with projections indicating that IoT-related applications could contribute to a market increase of approximately 12% over the next few years. As manufacturers continue to develop innovative solutions tailored for smart devices, the molded interconnect device market is likely to expand in tandem.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver in the Molded Interconnect Device Market, as manufacturers strive to reduce production costs while enhancing product quality. The integration of molded interconnect devices allows for streamlined manufacturing processes, which can significantly lower labor and material expenses. This efficiency is particularly appealing in industries such as telecommunications and automotive, where profit margins are often tight. Furthermore, the ability to combine multiple functions into a single device reduces the need for additional components, further driving down costs. As companies continue to seek ways to optimize their operations, the demand for cost-effective molded interconnect solutions is expected to rise, potentially leading to a market expansion of around 8% annually.

Growing Adoption in Automotive Sector

The automotive sector is increasingly adopting molded interconnect devices, which is a key driver for the Molded Interconnect Device Market. With the rise of electric vehicles and advanced driver-assistance systems, the need for reliable and efficient interconnect solutions has never been greater. Molded interconnect devices offer advantages such as reduced weight, improved reliability, and enhanced performance, making them ideal for modern automotive applications. The automotive industry is projected to account for a significant share of the molded interconnect device market, with estimates suggesting that it could represent over 30% of total market revenue by 2026. This trend indicates a strong potential for growth as manufacturers seek to innovate and improve vehicle functionality.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly shaping the Molded Interconnect Device Market. As industries face stricter regulations regarding product safety and environmental impact, the demand for molded interconnect devices that meet these standards is rising. Manufacturers are compelled to adopt materials and processes that comply with regulations, which can enhance product reliability and safety. This focus on compliance not only helps in mitigating risks but also opens up new market opportunities for companies that prioritize safety in their designs. The market is expected to see a growth rate of around 7% as companies adapt to these evolving regulatory landscapes, ensuring that their molded interconnect devices align with safety and environmental standards.