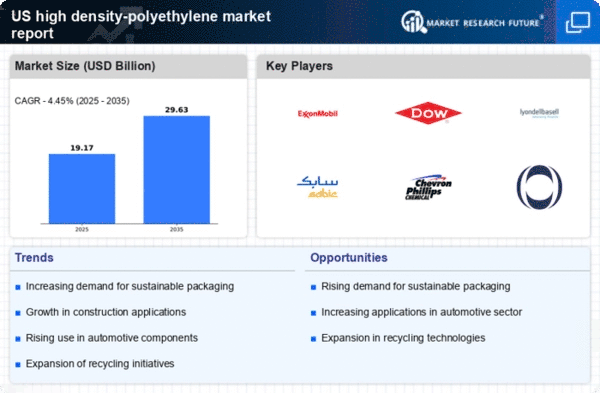

The high density-polyethylene market exhibits a dynamic competitive landscape characterized by robust growth drivers such as increasing demand from packaging, automotive, and construction sectors. Major players like ExxonMobil (US), Dow (US), and LyondellBasell (US) are strategically positioned to leverage their extensive production capabilities and technological advancements. ExxonMobil (US) focuses on innovation in polymer production, while Dow (US) emphasizes sustainability through its circular economy initiatives. LyondellBasell (US) is actively pursuing regional expansion to enhance its market presence, which collectively shapes a competitive environment that is both concentrated and responsive to evolving consumer needs.Key business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with a few dominant players exerting considerable influence. This concentration allows for strategic collaborations and partnerships, which are increasingly vital in navigating the complexities of supply chain disruptions and regulatory challenges.

In October ExxonMobil (US) announced a significant investment in a new high density-polyethylene production facility in Texas, aimed at increasing its output capacity by 20%. This strategic move is likely to bolster its competitive edge by meeting the rising demand for sustainable packaging solutions, thereby reinforcing its commitment to innovation and market leadership.

In September Dow (US) launched a new line of high density-polyethylene products designed specifically for the food packaging industry, which incorporates advanced barrier technologies. This initiative not only enhances product performance but also aligns with Dow's sustainability goals, indicating a strategic pivot towards environmentally friendly solutions that cater to consumer preferences.

In August LyondellBasell (US) entered into a partnership with a leading technology firm to develop AI-driven solutions for optimizing its production processes. This collaboration is expected to enhance operational efficiency and reduce waste, reflecting a broader trend towards digital transformation within the industry. Such strategic actions underscore the importance of technological integration in maintaining competitive advantage.

As of November current competitive trends are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are shaping the landscape, enabling companies to pool resources and expertise to address market challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as companies strive to meet the demands of a rapidly changing market.